Inside Apollo Asset-Backed Credit Company LLC (ABC)

The structure, the fees, what's inside and how the money is made

We’re heading into one of the more opaque corners of private markets.

So obscure, in fact, that to fully understand what we’re discussing today, you’ll want to read the primer on asset-backed finance first. If you missed it, you’ll find it here:

For long-time readers, this chart will explain quite a bit:

Today, we’ll do three things:

1️⃣ Break down the entity relationship and the fee layers

2️⃣ Look at what’s actually in the fund

3️⃣ Explain where returns are coming from

👉 Here’s another Apollo fund deep dive:

Disclosure: This case study is provided for educational purposes only and does not constitute an offer, solicitation, or recommendation to buy or sell any security or financial instrument. Nothing herein should be construed as legal, tax, investment, or financial advice. All opinions are my own and may change without notice. Readers should perform their own due diligence and consult qualified professionals before making any investment decisions.

The Pitch

Apollo Asset Backed Credit Company LLC (“ABC”), launched in September 2023, is a holding company investing in Asset-Backed Finance (ABF) assets. It operates as a continuous monthly private offering to accredited investors.

👉 If you want a full evergreen fund refresher, start here:

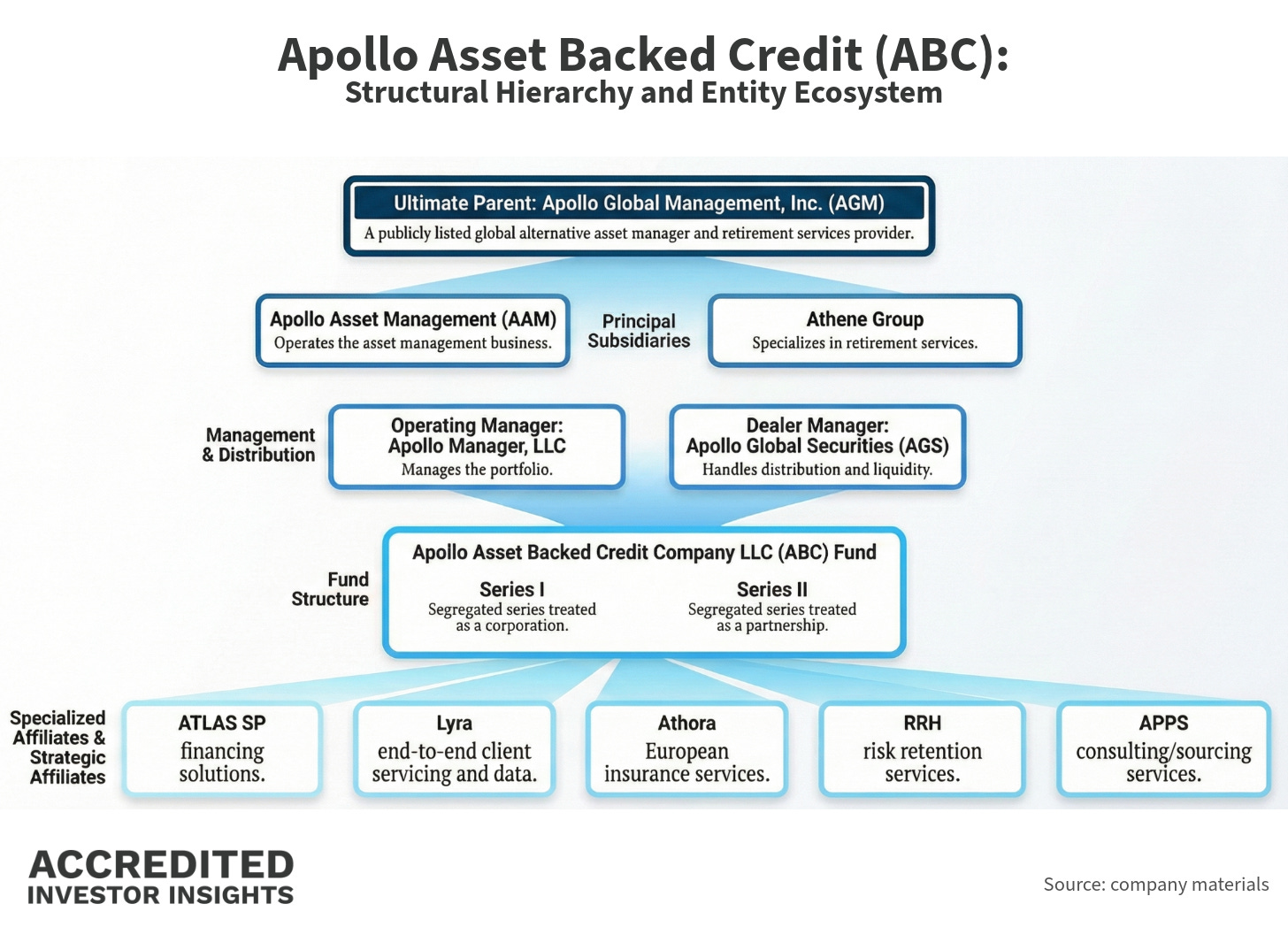

The entity structure is a thing to behold. Apollo, to their credit, posted a 208-page brochure (amply titled Form ADV Part 2A) that outlines various business practices (and the structural relationship between various entities):

ABC has two segregated investment series:

Series I (taxed as a corporation)

Series II (taxed as a partnership)

Both invest pro rata in the same underlying assets through wholly owned subsidiaries (effectively, this is the same strategy in different tax wrappers).

Apollo allocates capital across five buckets: consumer finance, residential mortgage loans, commercial real estate, hard assets, and financial assets.

💰 Annualized yield, you ask?

Series I: 4.5% to 5.6% (depending on share class)

Series II: 5.8% to 7.8%

🐎 Hold your horses, cowboys! We’ll take a look at where those distributions are actually coming from in a minute.

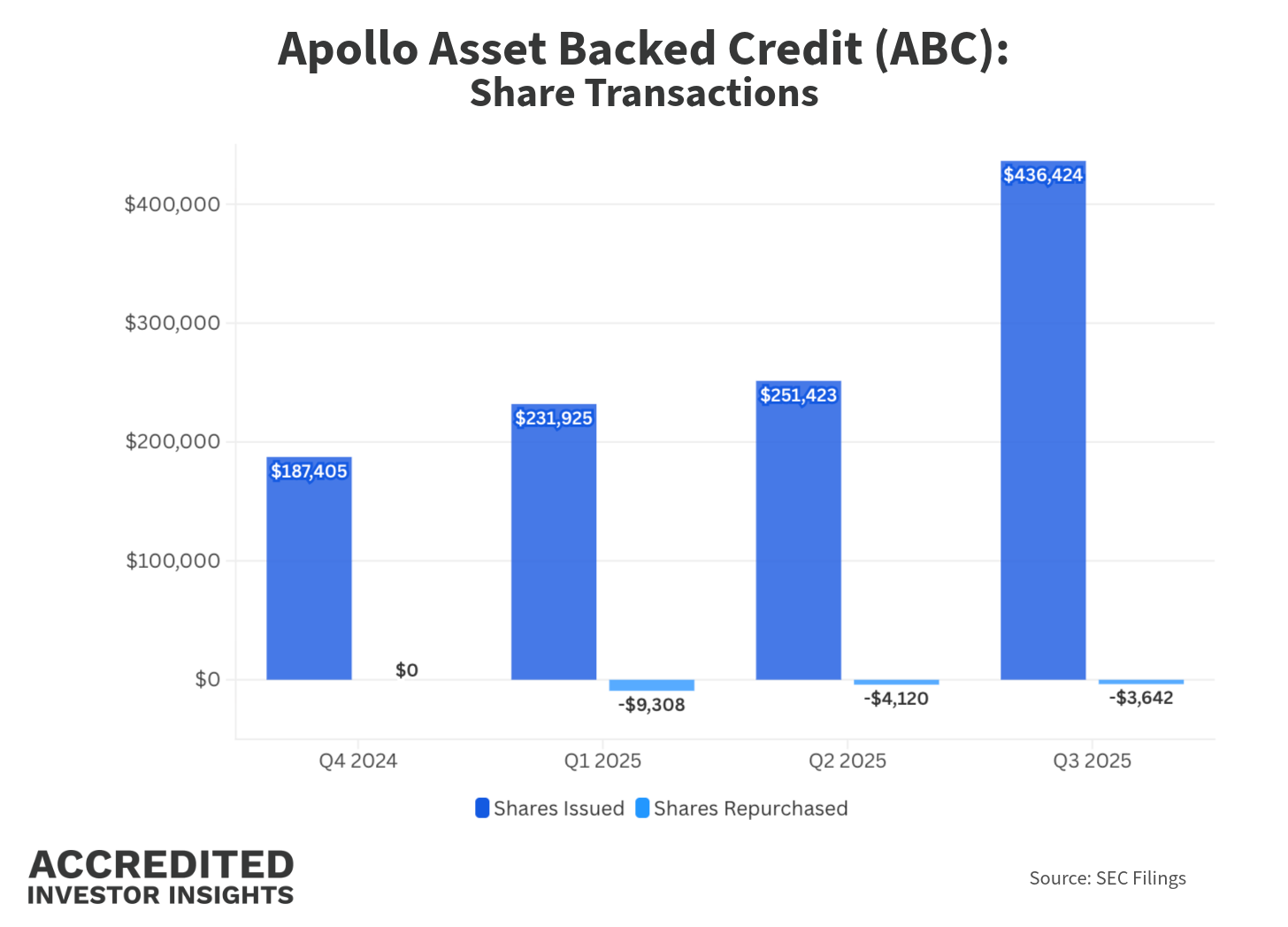

Liquidity & Tender Offers

Liquidity is offered via a quarterly Share Repurchase Plan:

Repurchases capped at 5% of aggregate NAV per quarter

Priced at prior quarter-end NAV

Board has full discretion to scale back or suspend repurchases

For the nine months ended September 30, 2025, ABC repurchased 667,765 shares (~$17.1M).

Translation: quarterly liquidity windows, capped at 5%, and entirely at the Board’s discretion. If redemptions spike, you’re in line. This is standard for evergreen vehicles.

Watching liquidity is paramount in evergreens, friends. Here’s why:

Fees

Scroll back and take a look at the hierarchy of the entities. There are fees at pretty much every level. Let’s unpack: