Inside Coller Private Credit Secondaries (CollerCredit)

Fees, holdings, and why private credit secondaries are only getting started

Private credit secondaries were not on my BINGO card this year — but here we are.

Today’s case study looks at an evergreen private credit secondaries fund. One of the first of its kind… and almost certainly not the last.

We’ll do three things:

1️⃣ Break down the fee structure (this one is notably better than some we’ve looked at recently)

2️⃣ Look at what’s actually in the fund

3️⃣ Explain where returns are really coming from

👉 For comparison, here’s another secondary fund, infrastructure:

🧭 Before we get into the weeds, let me help you get oriented. Think of this as the map of where we are (with links if you want to go deeper).

First, evergreen funds.

Evergreen funds continuously sell shares and recycle capital, unlike drawdown funds, which have a defined investment and liquidation timeline. Almost any asset can live inside this structure (real estate, infrastructure, private credit… probably teddy bears 🧸, if someone tried hard enough).

👉 If you want a full evergreen fund refresher, start here:

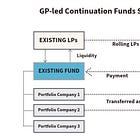

Second, some evergreen funds invest in secondary stakes in other funds.

These funds acquire LP interests on the secondary market through either LP-led or GP-led transactions (the difference is important).

👉 Learn more about LP- vs. GP-led secondaries here:

Third, some secondary funds focus specifically on private credit assets (which is where CollerCredit comes in).

From here, you’d want to read:

How secondary pricing and valuation actually work (with an example): LINK

The accounting concept of “practical expedient” (❗️it sounds boring and dry, but everyone should know this): LINK

Disclosure: This case study is provided for educational purposes only and does not constitute an offer, solicitation, or recommendation to buy or sell any security or financial instrument. Nothing herein should be construed as legal, tax, investment, or financial advice. All opinions are my own and may change without notice. Readers should perform their own due diligence and consult qualified professionals before making any investment decisions.

The Pitch

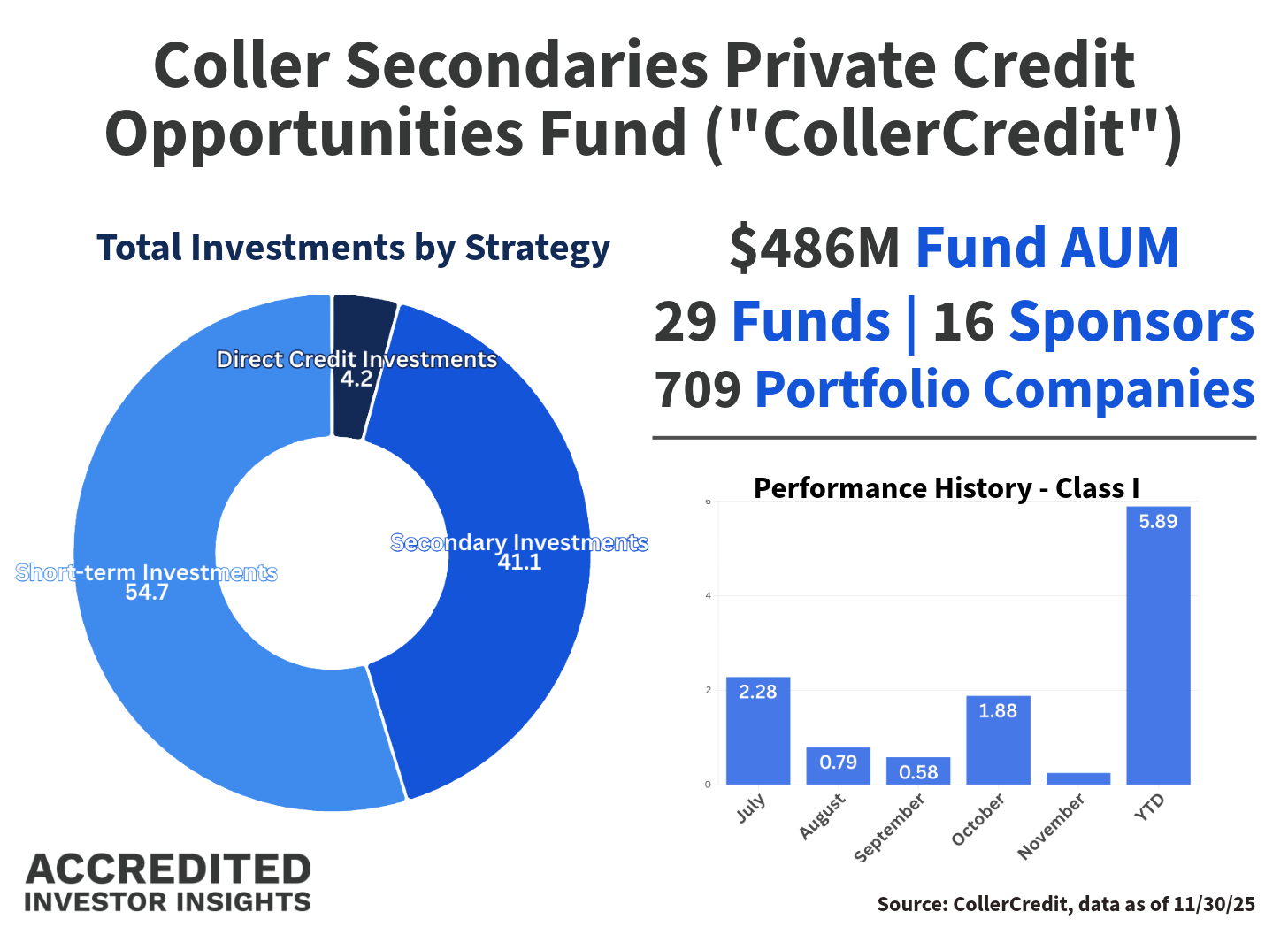

The Coller Private Market Secondaries Fund is a closed-end interval fund registered under the Investment Company Act of 1940. It commenced operations on July 1, 2025.

Investment Objective & Strategy

The Fund’s stated objective is to generate long-term returns, primarily through investments in private credit secondaries.

Under normal market conditions, at least 80% of net assets (including leverage) will be invested in private credit secondaries acquired through:

LP stake purchases

GP-led restructurings and continuation vehicles

Direct investments and co-investments

The strategy spans the capital structure, from senior to subordinated credit, and includes performing, opportunistic, and distressed situations. Investments may also include equity kickers and post-restructuring equity exposure.

Liquidity & Tender Offers

Liquidity in interval funds is limited by design.

👉 Need a tender offer/interval fund refresher? I got you:

For CollerCredit specifically:

The Fund expects to conduct periodic tender offers, typically quarterly

Each tender offer allows redemptions of up to 5% of net assets, subject to Board approval

Early repurchases, defined as shares held for less than one year, are subject to a 2% redemption fee, which is standard for interval funds

Because the Fund is still in its early days, significant outflows are unlikely in the near term (while investors remain within the one-year penalty window).

Fees

⚠️ Important: Fees are only one part of the equation, but they drive incentives, and incentives drive behavior.

Compared to recent case studies (this one, or this one), this Fund’s fee structure is relatively investor-friendly. Here’s the breakdown: