🗞️ Sunday Digest: Private Markets Insights

The State of US Housing + Private Equity’s Exit Problem (and How You Will Solve it)

Happy Sunday!

Two things on our radar this week:

📉 A snapshot of the U.S. housing market

🔁 And a growing shift that individual investors should be tracking closely: secondary transactions.

Before we dive in:

Accredited Insight is one-of-a-kind: we are the only voice offering a perspective through the LP lens. We cover private credit, private equity, and CRE investing, drawing on countless deals we’ve seen.

By becoming a paid subscriber, you will gain access to our database of over 30 case studies and articles on everything you need to know to become a better investor. If you are a GP, this is your window into the world of capital allocators. Click below to choose your plan:

👉 $10/month or $100/year.

🏠 The State of US Housing

Earlier this month, Apollo published a US Housing Outlook - 121 pages of charts, covering everything from demographic trends to offer activity on active listings.

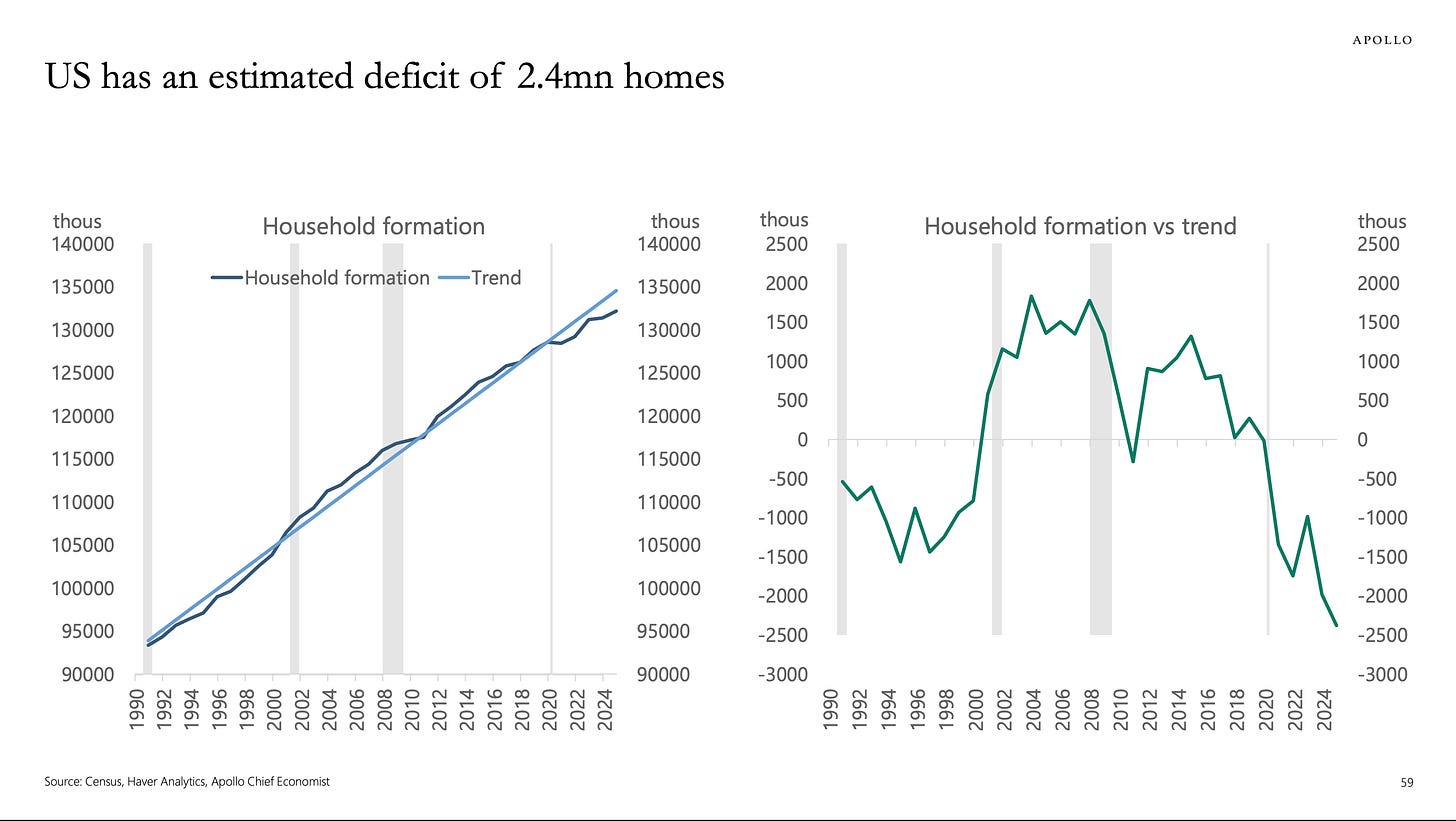

Several things jumped out. Take a look at the household formation (on the left) and the supply of housing (on the right):

What else caught my attention:

First-time homebuyers are getting older. The median age has jumped from 30 in 2008 to 38 today. (Fun fact: the largest age cohort in America is 33 — just entering their buying years.)

40% of US homes don’t have a mortgage - and for those with mortgages, mark to market LTV ratio is below 50% (I’m assuming this is the LTV where the V part = current market price. This number is the lowest since 2013, no doubt, due to the very rapid home appreciation since 2020)

Builders are still on the sidelines. Residential investment is just 3.5% of GDP, near all-time lows

Investors still active. About 17% of home purchases are investor-driven — well above pre-GFC levels.

Built-to-rent is on the rise, approaching 10% of all single-family starts.

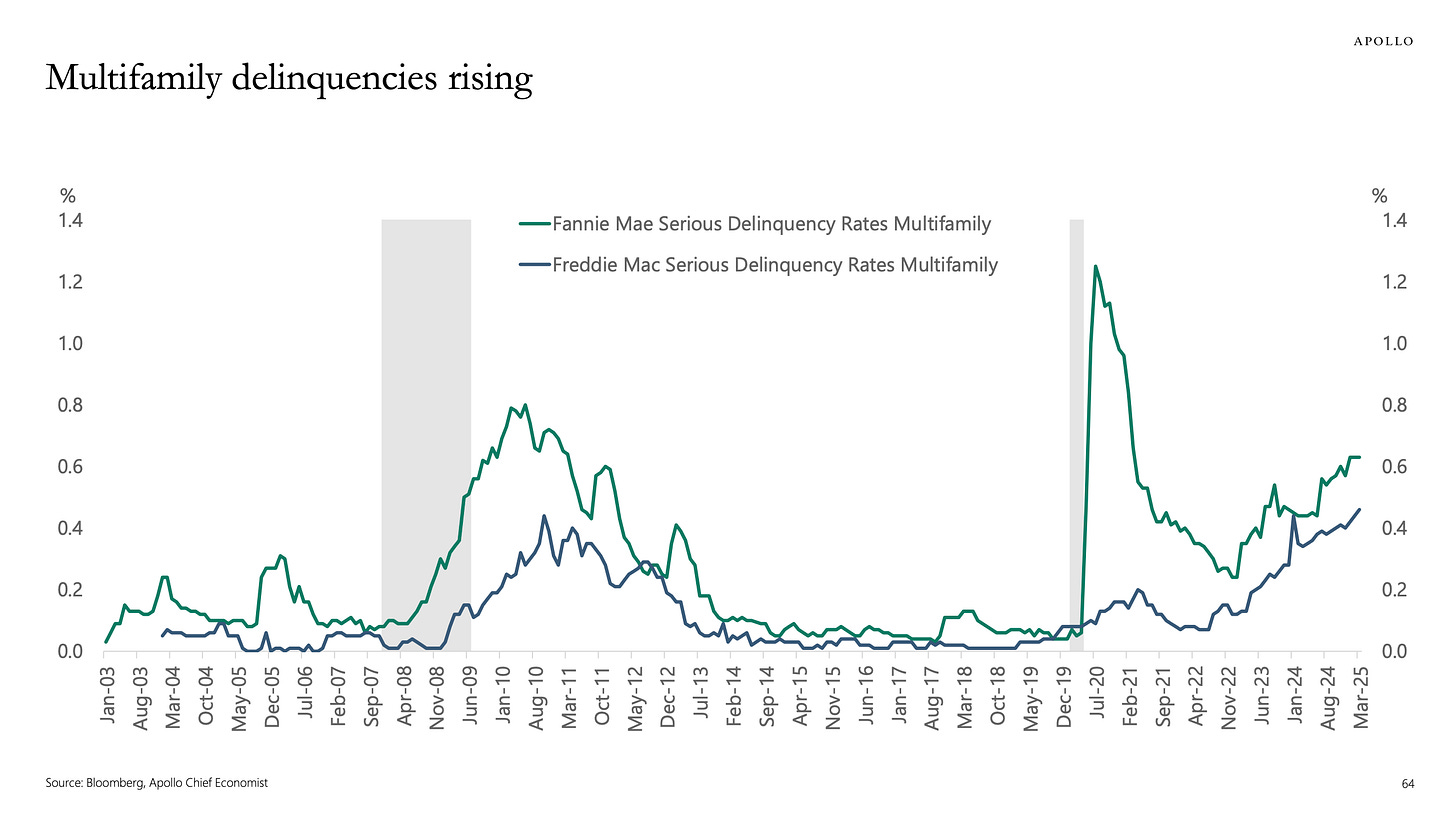

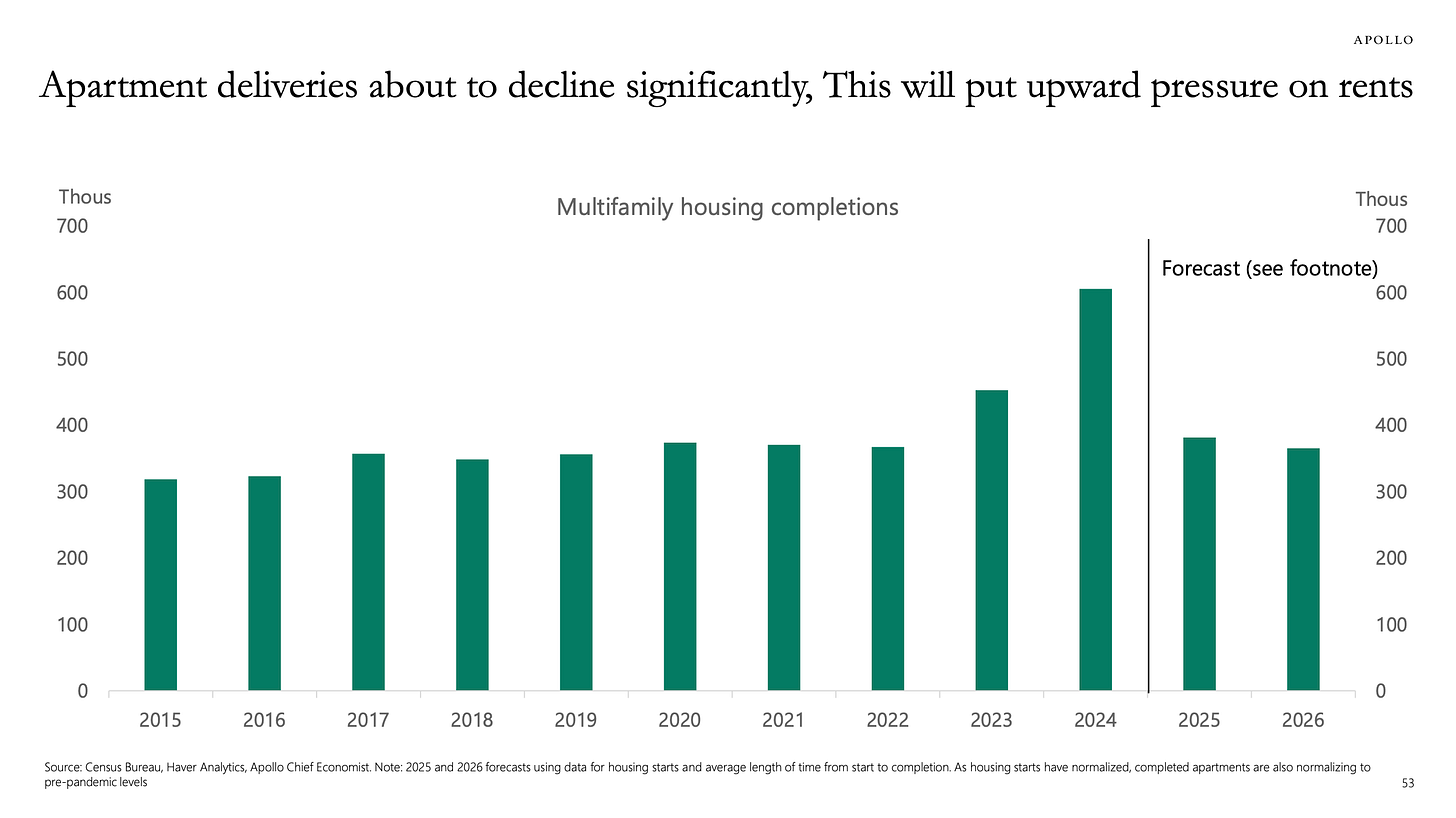

Multifamily pain: Delinquencies are climbing, but with new deliveries slowing, expect vacancy rates (currently at 7%) to stabilize.

Speaking of multifamily: AI can generate comprehensive market reports for you in under 10 minutes. Click this to learn how.

♻️ One Fund’s Junk Is Another Fund’s Treasure

You might recall a brief mention of Verdad from our earlier piece on yield curves. Dan Rasmussen (the man behind the fund) wrote an article on the growing liquidity crunch in private equity.

In his latest piece for the Financial Times, Dan outlines the cracks forming in the PE model:

Fewer exits = fewer distributions

Structural issues like overvaluation, excessive leverage, and market saturation are now starting to show

Default rates are up, returns are down

“The question now is not whether the model is being broken. It is whether the exit is wide enough for everyone trying to leave.” — Dan Rasmussen

Now this is where this becomes interesting, and why you all need to PAY ATTENTION: institutional LPs have an exit button. It’s called the secondary market, and the level of activity is picking up:

NYC’s pension system sold $5B worth of PE stakes

Yale is selling part of its PE portfolio; Harvard plans to offload $1B in PE holdings, and the list goes on.

So, who’s going to be the buyer?

Drumroll, please... 🥁

You.

That’s right. Just take a look at this:

StepStone just filed to launch a secondaries fund targeting private wealth investors (SEC filing)

According to the Secondaries Investor, firms like Franklin Templeton, Lexington, ICG, Ardian, Pantheon, and others are launching evergreen secondaries funds aimed at the same audience.

What are secondaries funds? Here’s a primer:

👉 WHY DOES THIS MATTER? This convergence suggests that individual investors are becoming the new liquidity providers in the private equity landscape. While this democratization is being marketed as access to previously exclusive assets, I can’t help but wonder if retail investors will end up holding the bag (by absorbing risks institutions are eager to shed).

As always, do your due diligence, and - I implore you - understand the underlying assets.

And last, but not least: I was interviewed on Adam Gower’s podcast. If you are a long-time reader, you already know what I said on the podcast 😅 - check out other interviews!

New here? Some of our most popular articles:

With that, thank you for reading (and supporting!) If you haven’t yet subscribed, now’s the perfect time:

Couple trends here that are worth highlighting.

First of all - single home builders got CRUSHED in the GFC, and I “think” have mostly not come back. I still recall huge, empty neighborhoods outside of Sacramento while in college at UC Davis, during 2009. Eerie. Like with dustballs blowing in the wind.

Second of all - since breaking the gold standard in ‘71, wages and asset prices have totally decoupled from one another. It used to take 2 years of savings to buy a home. Today it’s like 8 - 10 years.

That is a recipe for disaster, IMHO.