Five Q(uestion)s for Cliffwater's Five Ws

Or What Happens When Assumptions Break? A guest post by Rachel Volynsky

Cliffwater recently published a paper titled Back to Basics: The Five Ws of Private Debt, arguing that much of the criticism directed at private credit reflects confusion (specifically, the conflation of private debt with the broadly syndicated loan (BSL) market).

What Cliffwater Argues

Cliffwater contends that recent skepticism around private debt is misplaced. Headline defaults and stress in public credit markets, they say, are being wrongly attributed to private strategies.

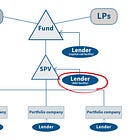

They argue that private debt is structurally different: tighter documentation, stronger alignment, direct lender oversight, and tools like covenants, overcollateralization, and ring-fencing that are designed to protect lenders through cycles.

To help allocators evaluate risk consistently, they introduce a “Five Ws” framework:

Who is borrowing

What supports repayment

When capital returns

Where the lender sits in the capital structure

Why the borrower needs capital

Anyone who has ever worked in lending will recognize this as Lending 101: a textbook how-to on loan underwriting.

In today’s guest post, Rachel Volynsky asks a question that goes several steps further:

What happens when the premise breaks?

-Leyla

About the author:

Rachel Volynsky is President of RVSK Advisory, where she advises family offices and institutional investors on asset allocation, portfolio construction, and private markets. Previously, she served as Chief Investment Officer at Mercer Global Investments Canada, overseeing $30 billion in multi asset solutions for pension plans, endowments, and family offices, and developing strategies to balance growth, capital protection, tax efficiency, and wealth transfer.

Her investment philosophy emphasizes judgment over fads, empirical evidence over noise, and resilience over short term performance. Rachel is a seasoned investor whose career includes senior roles at SEI Canada, Calvert Investments, Invesco Trimark, TD Asset Management, and the Ontario Teachers’ Pension Plan Board. She holds an MBA from the Schulich School of Business and is a CFA Charterholder. Earlier in her career, she served as a Military Officer in a Strategic Intelligence Unit. You can find her on LinkedIn.

👉 Here are some Cliffwater deep dives:

When Assumptions Break: Five Questions on Private Credit Convergence

I came across this white paper and genuinely liked it. It offers a timely refresher on private credit fundamentals and clearly lays out the many flavors of the asset class, which is useful given how heterogeneous private credit has become. The paper rightly cautions against headline-driven conclusions, arguing that many critiques of private debt reflect a misdiagnosis. Safety, it reminds us, is not about yield or labels, but about the source of repayment and the structural protections put in place at origination. All of this is correct.

The paper then states that private debt is mistakenly conflated with BSL headline defaults and goes a long way toward reassuring us that the proverbial cockroaches are neatly contained within BSL.

They also graciously equip allocators with the “proper” due diligence questions to ask, anchored in a framework called the Five Ws. The stated goal is to re-anchor LPs due diligence around private credit lending fundamentals. The paper then explicitly argues that the Five Ws allow investors to evaluate private credit consistently across corporate, asset-based, and specialty lending, with an emphasis on portfolio construction, duration, capital structure, recovery, manager selection, diversification, and underwriting discipline. Again, this was very useful and timely.

Question One: What Happens When Assumptions Break?

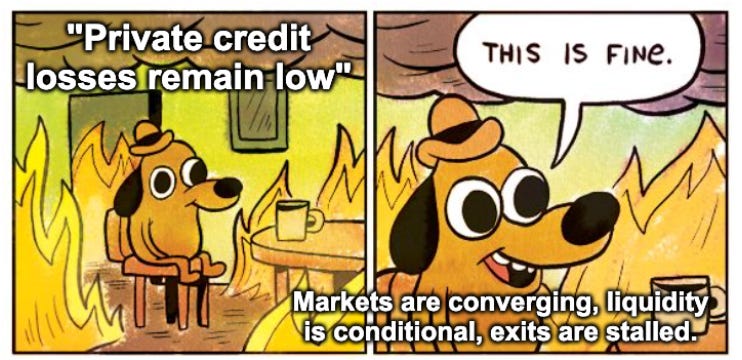

Alas, somehow, reassured I was not, and I could not shake the feeling that I was being gently reprimanded for even having concerns. What felt unanswered to me was the question that matters most when cycles turn: what happens when assumptions break.

Yes, the framework works well in a world where markets remain segmented and behaviors remain distinct. But convergence is precisely the behavior that undermines this premise and is the source of my discomfort.

Maybe I am reading too much into it, but were we not told throughout the recent past about convergence? I understand that this narrative was meant to reassure investors that private credit still has ample room to grow at the expense of other credit providers, but it raises a more fundamental question. Does convergence also mean that once distinct credit providers are starting to look increasingly similar?

That appears to be the case according to Moody’s, which notes that historically separate pockets of credit are now serving overlapping borrower bases and competing on similar terms. In turn, borrowers are actively shopping between public and private markets, and documentation standards, while still differentiated on paper, are coming under pressure in practice. That may be what the other side of the convergence coin looks like.

Question Two: Are We Converging at an Inconvenient Moment?

That brings me to my second question.

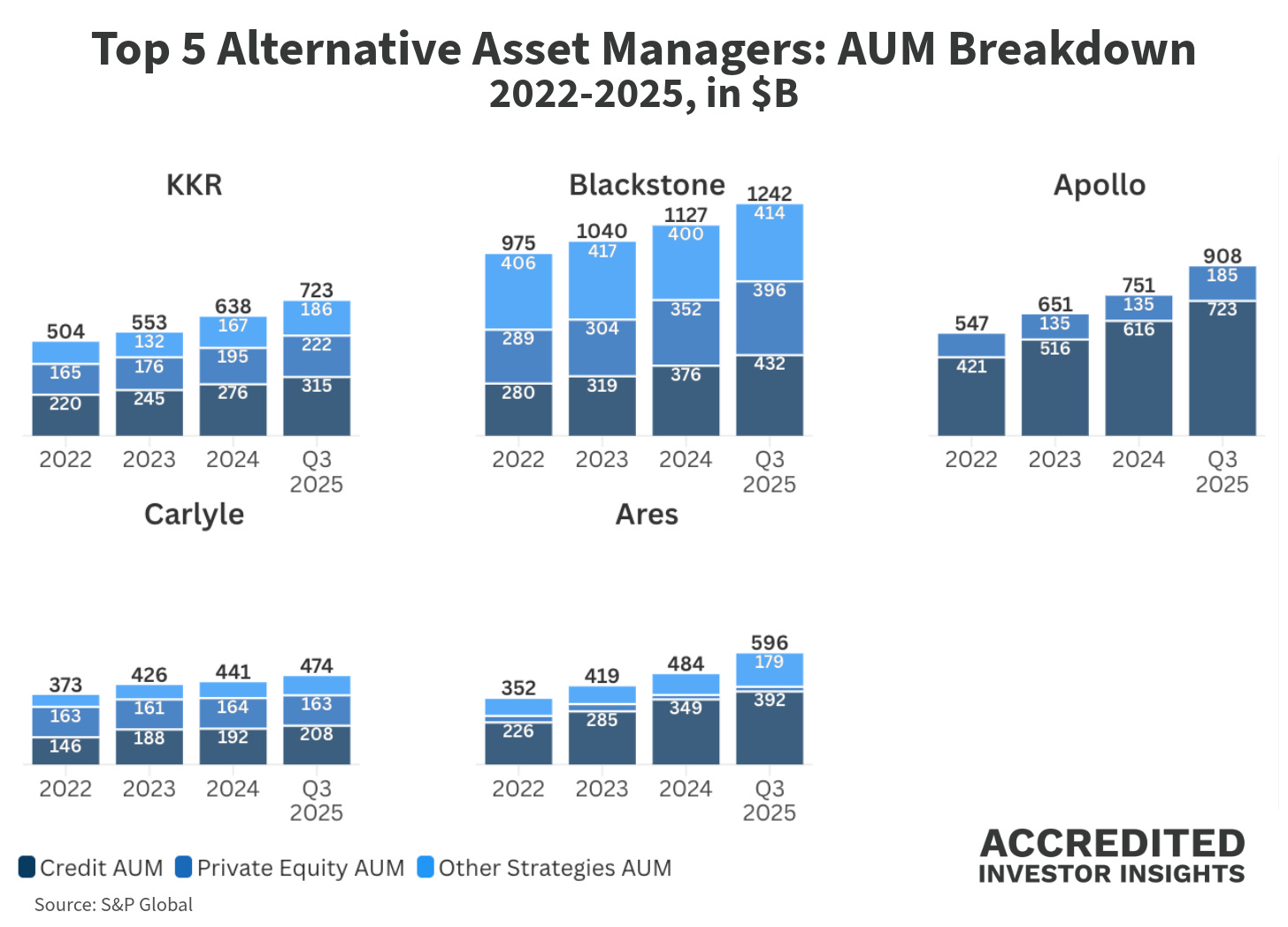

Since 2020, capital inflows into private debt have accelerated meaningfully, with AUM rising from roughly $1.2 trillion in 2020 to about $2.3 trillion by 2025. That implies approximately $1.1 trillion of incremental capital entering the ecosystem over just 5 years, with the asset class projected to continue growing at a 13-15% annual clip through 2030, reaching roughly $4.5 trillion in AUM.

This expansion is occurring just as direct lending, the largest private credit borrower segment (~50%), is grappling with its own challenges, including growth pains, weak private equity exits, and subdued deal flow.

If that is the case, does it not follow that these newly converged players will be increasingly competing for the same limited pool of loans? Or maybe it is safe to assume that when capital floods the system, borrowers, structures, documentation, and lender behavior increasingly begin to resemble one another across BSL, private debt, and even public credit markets.

Question Three: Should We Be Watching the BSL and BDC Markets More Closely?

Which leads to my third question. If convergence is indeed underway, should we not be paying closer attention to signals coming from other parts of the credit ecosystem, such as the broadly syndicated loan market and, closer to home, the BDC space?

Transparency in private credit is not exactly abundant, given that opacity and illiquidity aren’t bugs; they are the asset class’s essential features. So, even if we accept that the assertion most recent slew of private credit critiques stemmed from comparison to BSL (which is not entirely accurate)¹ the dynamics in the BDC market are tougher to ignore.

As of early 2026, BDC markets were under visible pressure as public vehicles traded at persistent discounts to stated NAVs, exposing a widening gap between private valuations and public market clearing prices. Investor redemptions across large non-traded BDCs accelerated through late 2025 and early 2026, with withdrawals reaching roughly 5% of net assets in several vehicles.

The most visible episode involved Blue Owl Capital, which abandoned a proposed merger of a private BDC into a publicly traded one that was trading at roughly a 20% discount to NAV, followed by an increase in redemption limits at Blue Owl Technology Income Corp (OTIC) from 5% to 17%.

Separately, BlackRock TCP Capital disclosed significant loan write downs in early 2026, implying an expected NAV decline of nearly 20% and prompting an immediate share price repricing.

While each case had idiosyncratic drivers, together they suggest that where there is smoke, there is fire.

Question Four: If Markets Converge, Do Losses and Returns Converge Too?

This brings me to my fourth question, namely my concerns about credit quality, which is the defining feature of any form of credit.

Yes, admittedly, reported losses remain low. But if credit is credit, and if markets are converging, should losses in non-investment grade credit, whether private or broadly syndicated, not be higher and more consistent with historical averages and public credit outcomes?

Yes, the documentation is tighter we are told, but what about that PIK, NAV lending, CFO and continuation funds. I can ramble here some more, but you get the idea.

And that begs the follow up question, (perhaps most important one) if markets are converging, should returns not converge as well? If so, how am I meant to be compensated as an investor when losses are maybe rising, returns start to resemble those of public markets, while fees remain high? Yes, leverage has historically bridged that gap, but that’s yesterday’s news.

Question Five: Is Periodic Liquidity a Feature or a Bug?

And finally, my fifth question. What about that periodic liquidity embedded in many NAV based funds? Is that a feature or a bug?

The latest private BDC drama exposed a critical fault line, namely that liquidity in private credit is often conditional, not contractual. That liquidity functions well only at the pleasure of the underlying investors and trust can erode quickly once patience runs thin. Yes, for now, it is the domain of the BDC market, but aren’t we converging?

When It Stops Working as Advertised

The Five Ws framework explains how private debt is supposed to work. What it does not ask is how it behaves when it stops working as advertised.

Under those conditions, often facilitated and accelerated by convergence, the relevant diligence question is no longer just who the borrower is or where the lender sits in the capital structure, but how the strategy performs when correlations rise, exits stall, amendments proliferate, and liquidity becomes scarce.

So far, we have heard plenty of reassurance, but most of it comes from within the asset management ecosystem itself. A smaller and more independent set of voices does exist, including Moody’s, the Financial Times, The Wall Street Journal, and independent commentators, and they have not been shy about raising concerns. I would add my own voice to that independent camp.

I count myself as an experienced investor who understands how to construct a compelling narrative. But I can spot a good story with cracks from a mile away, and I am not shy about asking questions. My standard operating principle is trust but verify, and I would welcome suggestions on how to independently verify many of the claims embedded in this reassuring narrative, particularly given that limited transparency is a defining feature of private credit. I welcome pushback, objections, and additional substance.

For the avoidance of doubt, I like private markets, have invested in them, and expect to continue doing so selectively.

¹ First Brands and Tricolor originated as BSL credits, with later exposure shifting into private credit and BDCs.

Fully agree, there is significant stress under the hood as USD debasement continues guided by Fiscal Dominance.

Interesting. New assumptions are nice, and we all know how horrible anyone and everyone is about predicting the future. I imagine asumptions not based upon evidence based research are at best a flip of the coin or wrose guesses. Where is the peer reviewed studies on convergence effects in ANY debt market?