Secondaries, 19% NAV Drop, and Cap Rate Projections

🗞️ Sunday digest: private markets insights 1/25

Happy Sunday! Every other week, we send a quick digest on what’s catching our eye across private markets.

Today’s lineup:

1️⃣ Private equity: EQT moves deeper into secondaries

2️⃣ Private credit: public BDC writes down NAV by 19%

3️⃣ Commercial real estate: cap rates expected to compress (plus sector-level highlights)

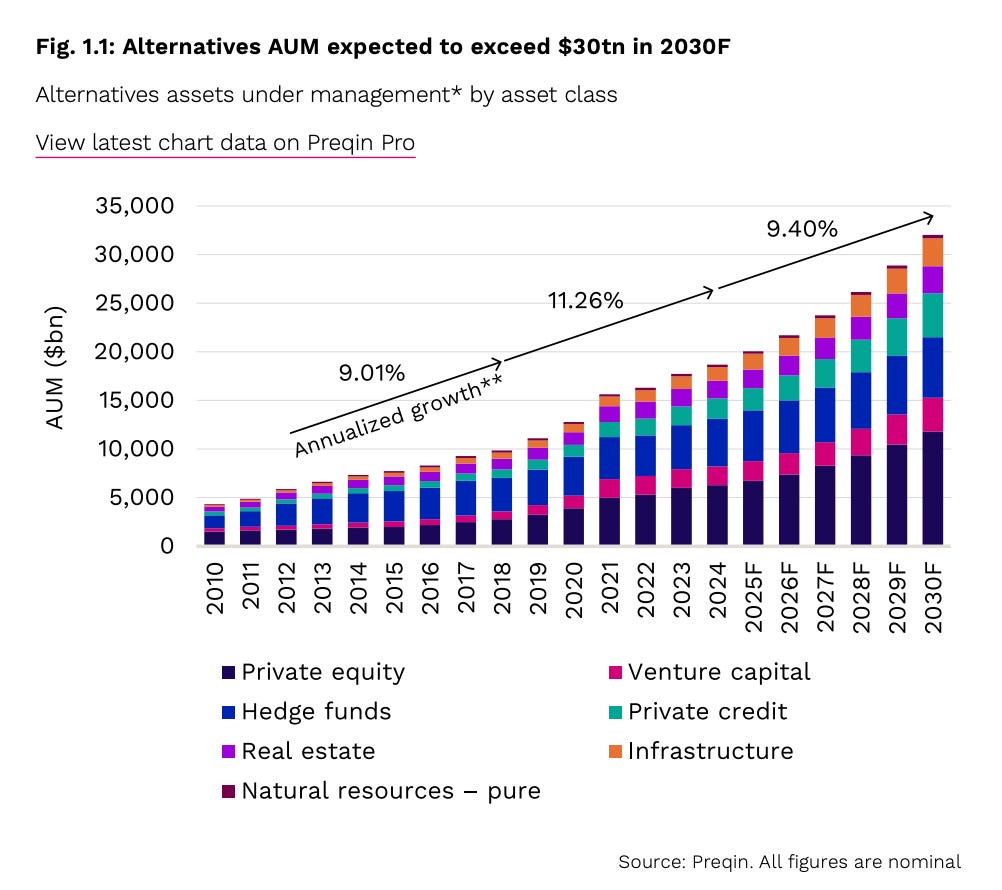

But first, take a look at this. Is it any wonder everyone wants a piece of the alts pie??

Before we dive in:

Accredited Insight delivers the LP’s perspective on private credit, private equity, and CRE, drawing on hundreds of deals, and thousands of conversations. Paid subscribers gain access to our database of over 30 case studies and articles on everything from evergreen funds to due diligence.

1️⃣ Private Equity

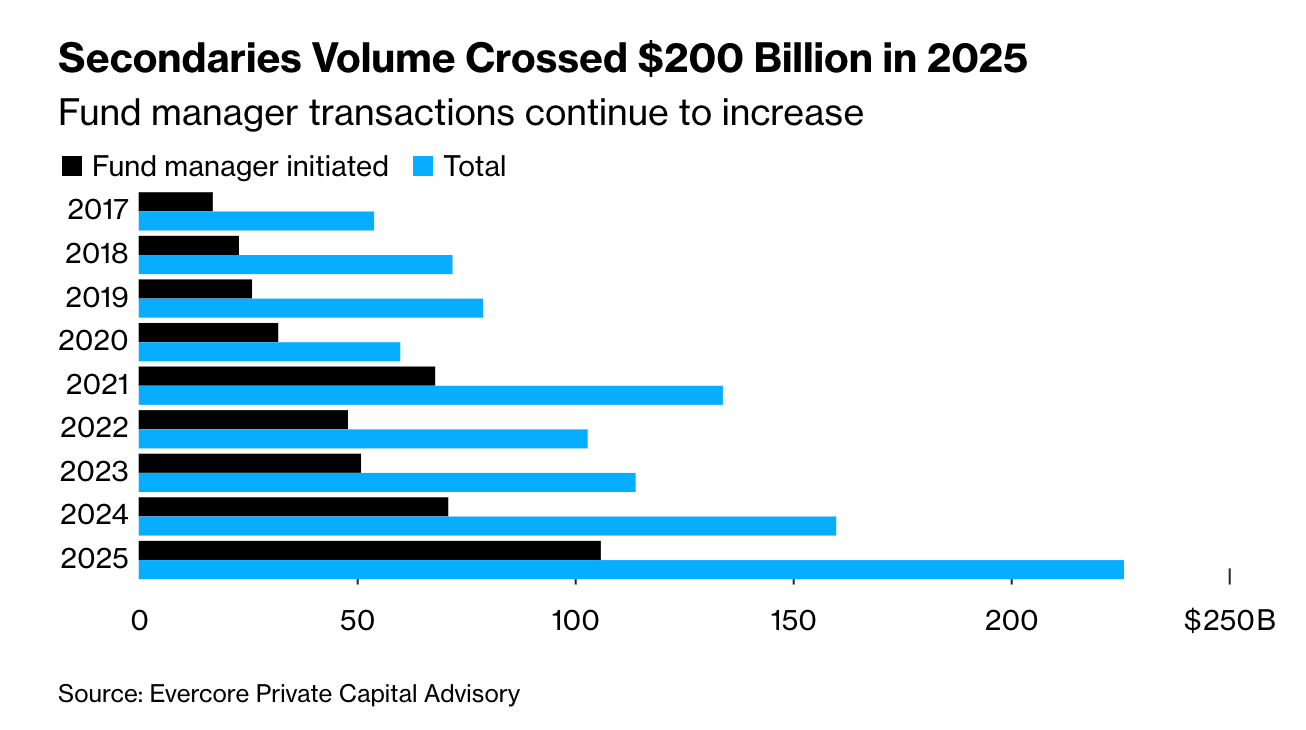

Are you sick of secondaries yet? Well, get used to them, they aren’t going anywhere:

EQT agreed to acquire Coller Capital, one of the OGs in the private equity secondaries market managing ~US$50 billion in assets, in a transaction valued at up to $3.7 billion. The deal, expected to close in Q3 2026, signals EQT’s push to scale beyond traditional buyouts into secondaries and credit, as it builds a broader private markets platform. (Bloomberg, WSJ)

‼️ I’m working on a write up on Coller’s Private Credit Secondaries fund. Stay tuned.

Why this matters for LPs:

This deal is another sign that secondaries have fully crossed into “core private markets” territory. What began as a niche liquidity tool is now a scaled, institutionalized strategy. For LPs, that likely means more fund offerings (and more competition among mega-platforms for capital, which might mean lower fees).

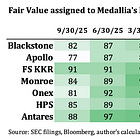

👉 On pricing of secondaries:

👉Invest in PE? start here:

2️⃣ Private Credit

This story dropped on Friday (Bloomberg). BlackRock TCP Capital, a publicly traded middle-market lending fund (BDC), announced a 19% NAV markdown for Q4 following a series of troubled loans, including exposure to e-commerce aggregators and a home improvement company now in liquidation.

That home improvement company? Renovo.

If the name rings a bell, it’s because the company made the news back in November when it suddenly went into Chapter 7 bankruptcy. I wrote about it here:

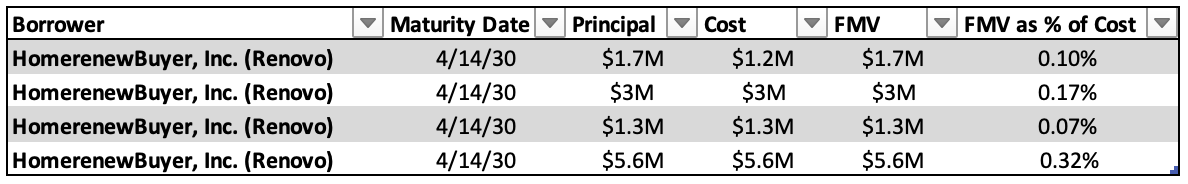

Here’s what TCP reported in its Q3 financials as of 9/30/25:

These loans represent just 0.7% of TCP’s loan book. What’s less clear is what other loans were written down to justify a 19% NAV decline in a single quarter. (Stay tuned, I’ll report back when the Q4 financials are released).

To its credit, BlackRock waived one-third of its management fee for the quarter—an unusual but welcome move. For context, that’s roughly 40 basis points.

❓ Why should LPs care?

Because this may be a preview of what’s coming.

From the SEC filing:

NAV per share: Estimated at $7.05–$7.09 as of December 31, 2025, representing an ~19% quarterly decline from $8.71 at September 30, driven primarily by issuer-specific credit events.

Net investment income (NII): Estimated at $0.24–$0.26 per share for Q4 2025, with ~10.9% of income coming from PIK.

Non-accruals are rising:

~4.0% of the portfolio at fair value

~9.6% at cost

(up from 3.5% FV / 7.0% cost the prior quarter)

Liquidity position:

~$483 million of available leverage

~$61.1 million in cash

👉 TCP is publicly traded, meaning investor liquidity comes from other investors (Investor A sells to Investor B). But fund-level liquidity still matters. For non-traded BDCs (where liquidity must come from the fund itself), watch liquidity like a hawk:

Shift in portfolio construction:

Average new investment size in 2025: $5.8 million (vs. $11.7 million in 2024)

First-lien exposure increased to ~87.5% of portfolio (fair value), up from 83.6% year-over-year

👉 Invest in private credit? Start here:

3️⃣ Commercial Real Estate

‘Tis the season for 2026 outlooks. CBRE’s report is worth a read.

Macro & investment:

U.S. GDP growth is expected to slow to ~2.0% as labor markets soften and inflation cools to ~2.5%.

CRE investment activity is projected to rise 16% to $562 billion, nearly back to pre-pandemic levels.

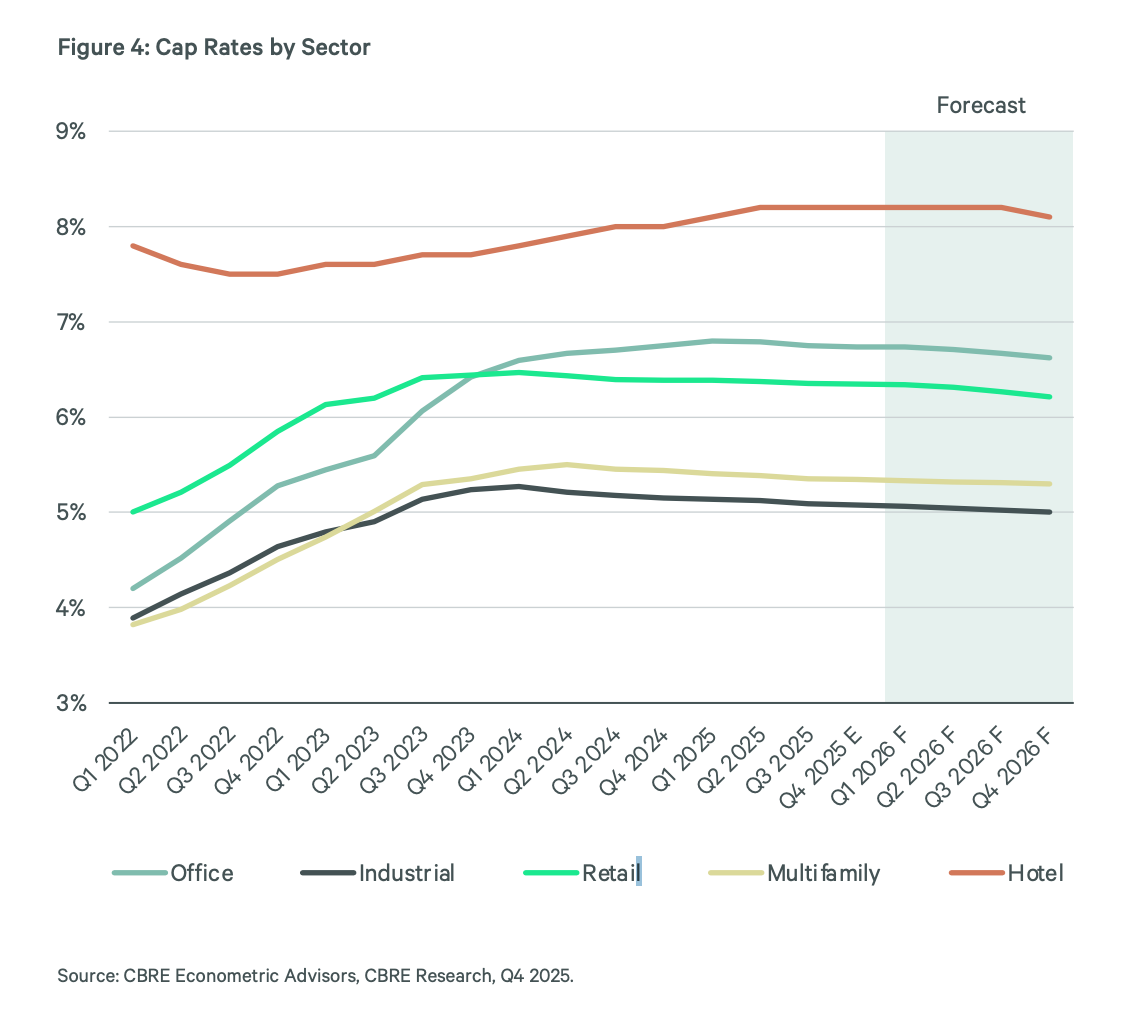

Returns are likely income-driven, not multiple-driven, because only modest cap rate compression of 5–15 bps is anticipated across most property types. Asset selection and active management will be critical. Why? Because cap rate compression won’t be there to save marginal deals:

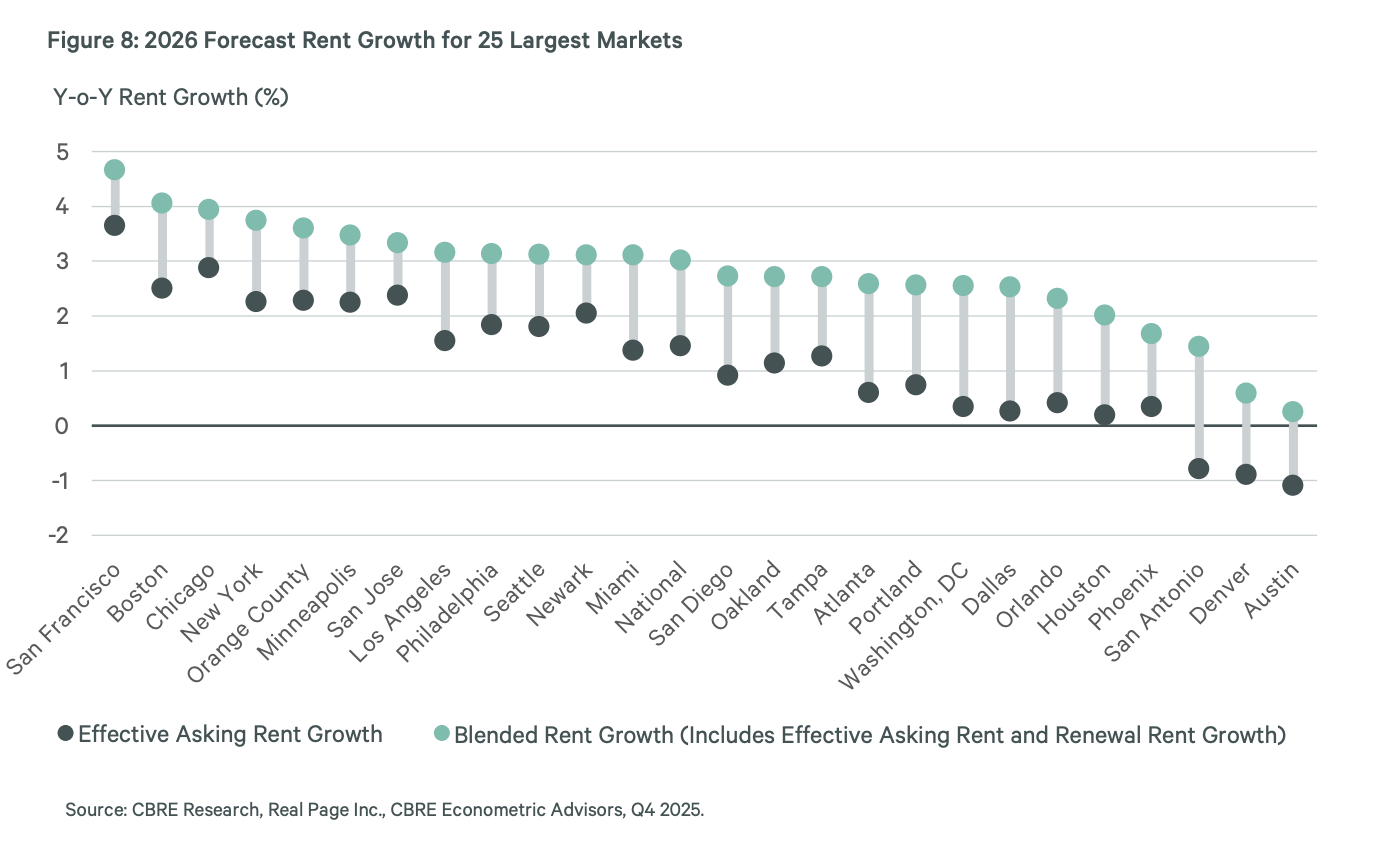

Leasing continues recovering from 2024 lows, with pace varying by sector and market.

Sector highlights:

Office: prime space tight by year-end, and spillover expected to lift lift secondary markets. Leasing expected to surpass 2019 levels.

Industrial: flight to quality favors newer assets. Leasing supported by reshoring and logistics growth (no surprises here)

Retail: demand from grocery, discount, and service retailers.

Multifamily: positive net demand; Sun Belt and Midwest are still working through a lot of new deliveries.

Data Centers: leasing to hit all-time high (when’s the top? asking for a friend).

Healthcare: completions are expected to drop sharply, which will stabilize vacancy (and generate rent growth for medical outpatient buildings).

Life Sciences: speculative lab/R&D pipeline expected to be delivered by EOY.

🏢 Invest in real estate as a limited partner? Here’s our series on how to read a real estate pro forma.

New here?

Check out some of our popular topics to get started: on private credit, private equity, and commercial real estate.

Thanks for reading! As always, if you have any suggestions, reply to this email, leave a comment, or find me on socials (X and LinkedIn)

-Leyla

As always there are lots of subsector and geographic details. For example, there is a bifurcation in industrial properties, with smaller spaces at significantly lower vacancy.

Fantastic digest! The TCP NAV markdown is definately a warning shot for private credit investors - that 19% drop in a single quarter is wild even with fee reductions. I've been tracking BDC performance for my portfolio and this reinforces why liquidity monitoring is so crucial right now. The point about secondaries becoming institutionalized makes alot of sense, especially with mega platforms competing for capital bringing potentialy lower fees for LPs.