The DPI Games - How the "Bulletproof" Metric Can Be Manipulated

What LPs Need to Know About Synthetic Payouts, Continuation Funds, and Premature Exits

The ultimate “show me the money” metric in private equity is, - without question, - DPI (Distributions to Paid-In Capital). Unlike IRR (internal rate of return) or TVPI (total value to paid-in capital), both of which lean heavily on projections and paper gains, DPI tracks cold, hard cash actually returned to investors.

But I’m going to burst your bubble (sorry): DPI is not bulletproof. It may feel like the cleanest performance measure, but even this one can be gamed. And in today’s slow-exit environment, one could argue that GPs - hypothetically, of course - have every incentive to get creative in how they generate that number.

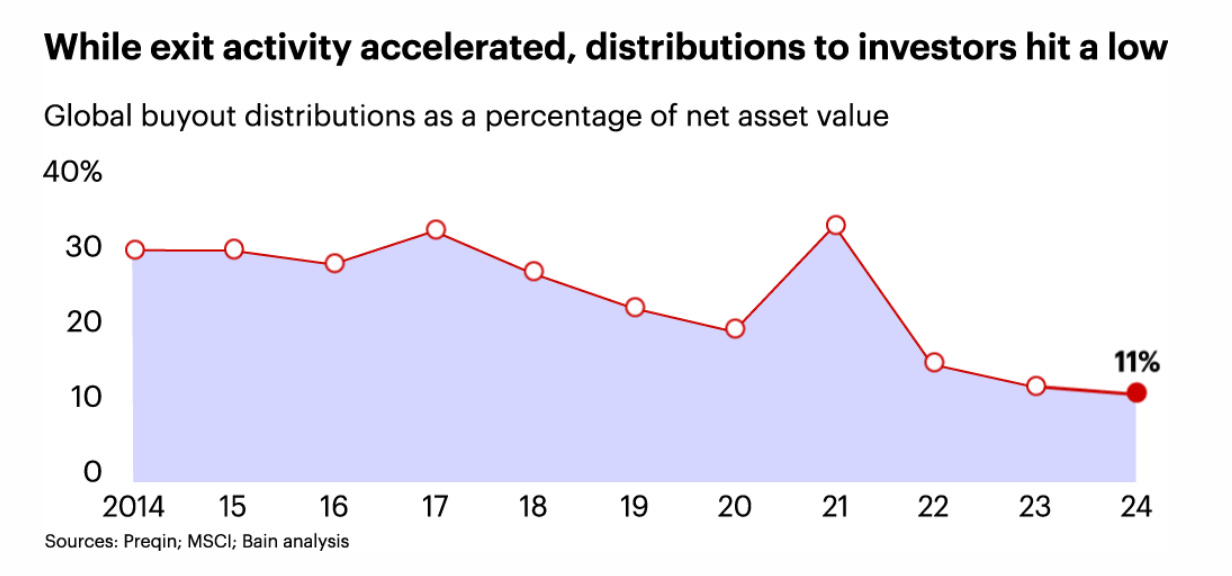

Do you see the problem? In 2024, distributions fell to just 11% of NAV, the lowest in a decade. With more than 30,000 portfolio companies stuck in PE hands, exits have slowed to a crawl. Yet while LPs wait for cash to come back, GPs are under pressure to raise their next fund, and some have found creative ways to accelerate DPI that don’t always reflect genuine value creation.

Today, I’ll cover:

What DPI actually measures (and how to calculate it)

Four ways DPI can be distorted

📌 Questions every LP should ask before taking reported DPI at face value

👉If you missed the post on how distributions in real estate private equity can be manipulated, read this.

👉And here’s an example of how a private credit fund can pay a high dividend yield without generating enough net interest income cash.

Want to learn more about IRR? I got you:

What is DPI?

DPI, or Distributions to Paid-In Capital, is a core metric in private equity that measures the cash returned to investors (Limited Partners, or LPs) relative to the capital they have invested.

DPI > 1.0x → you’ve gotten your capital back and realized a gain.

(Example: If you invested $100,000 into a fund and have received $123,000 in distributions, DPI = 1.23x)DPI < 1.0x→ you haven’t been made whole yet.

👩🏫 Class, you should be ready for this quiz —

Sources of DPI

In private equity, DPI comes from actual cash returned to LPs, but not all cash is created equal. Typical sources include:

Exit proceeds: most DPI comes from selling portfolio companies, either via M&A, IPOs, or recapitalizations. Cash from these exits gets distributed to LPs.

Dividends and interest: sometimes, portfolio companies throw off income through dividends or interest, which counts toward DPI when distributed.

Partial exits: distributions can also include payouts from partial sales, secondary stakes, or recap events.

All of the above is pretty straightforward, right?

❗️Here’s the catch: just because cash is flowing out doesn’t mean true value was created. Let’s dig into the games that can be played.

How Can DPI Be Gamed?

Yes, DPI tracks real cash distributions, not paper gains, but don’t let that fool you. Even this seemingly “bulletproof” metric can be manipulated. Let’s take a look at four creative (and sometimes controversial) ways to inflate the number.

1. Synthetic Distributions via Fund Financing Facilities

The most common technique is using debt facilities, like NAV loans. Instead of waiting for portfolio companies to exit, a GP borrows against the fund’s assets and distributes the proceeds to LPs.

NAV facilities aren’t inherently bad (only about 20% are used to make distributions, according to ILPA), but it’s definitely a line item worth keeping a close eye on.