Toilets in CVs, Evergreen Trees, and $1.4B Wipeouts

🗞️ Sunday digest: private markets insights 11/30

Hope you had a wonderful Thanksgiving! Every other week, we send a quick digest on what’s catching our eye in private markets.

Today’s lineup:

🚽 Private equity: $1.4B down the toilet in a continuation vehicle.

💵 Private credit: remember Medallia? I have some additional info.

🌲 Evergreen funds: you gotta love unrealized (sometimes, one-day) gains.

Before we dive in:

Accredited Insight delivers the LP’s perspective on private credit, private equity, and CRE, drawing on hundreds of deals, and thousands of conversations. Paid subscribers gain access to our database of over 30 case studies and articles on everything you need to become a better investor. GPs, get a front-row look at how capital allocators think.

🚽 Private Equity

This story is making the rounds - partly because the headlines are absolutely hilarious (here, here, and here), and partly because the amount of money lost is pretty staggering.

Platinum Equity’s portable-toilet bet is turning into a $1.4 billion wipeout for Fortress, Ares, and Blackstone.

In 2021, Platinum rolled United Site Services into a single-asset continuation fund at a $4 billion valuation, letting legacy LPs cash out $2.6 billion while leaving new investors with a concentrated stake in a business that never lived up to its Covid-era growth story.

Rising rates, soft construction activity (main driver of demand for this company), and integration missteps drained cash, and now Platinum is preparing to hand the keys to lenders (including Clearlake Capital and Searchlight Capital Partners) - this is following an out-of-court restructuring in 2024. “Platinum hasn’t made a final decision on USS and it’s possible that a different solution may still emerge,” according to Bloomberg.

👉 Here’s your primer on continuation vehicles (what they are, why they are booming, and what LPs need to pay attention to):

💵 Private Credit

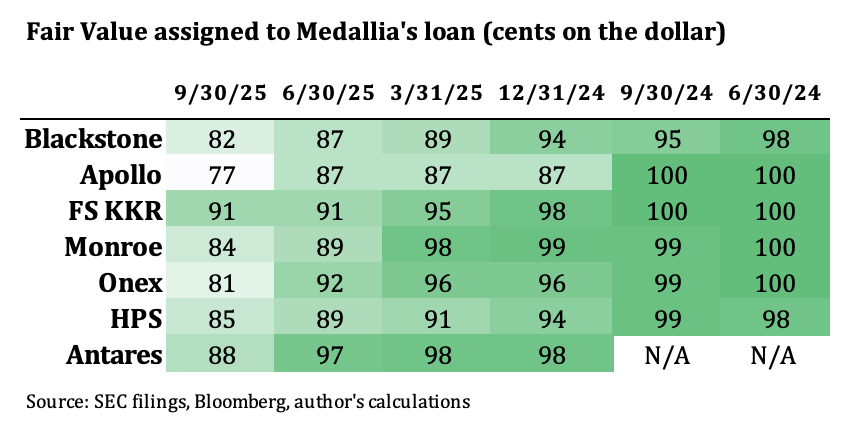

Remember this chart? A few weeks ago, this story made the rounds: different lenders are marking the same Medallia loan at very different values.

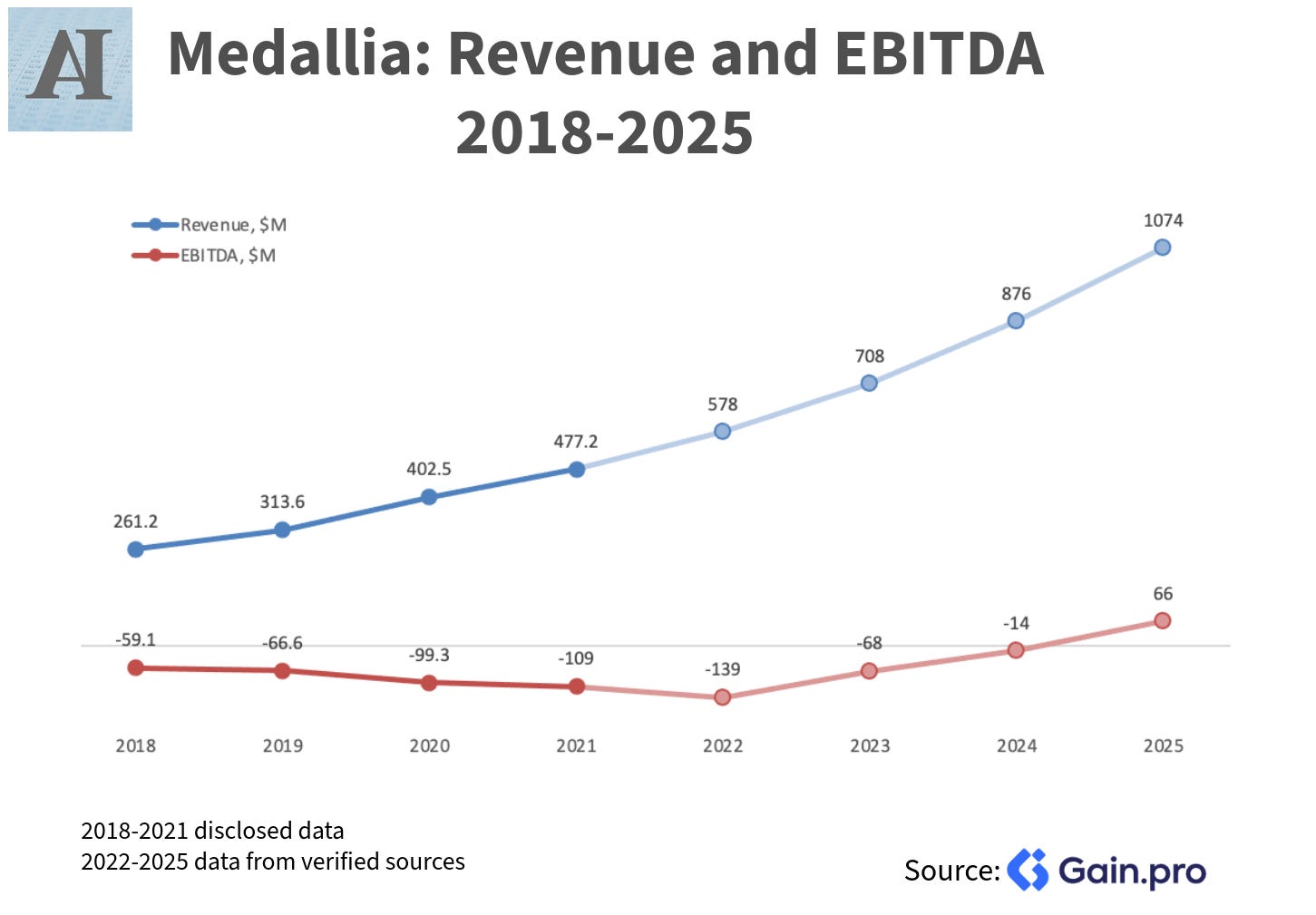

I was curious about what information exists on the borrower. Thoma Bravo took Medallia private for $6.4B in 2021 (at 13.4x revenue), and the only concrete recent datapoint I can find is a reference to “30% growth in demand”, which could mean almost anything.

So I asked the team at Gain.pro what they had on the company. Here’s what they shared:

This actually looks pretty good, doesn’t it?

Unfortunately, we still don’t know where Thoma Bravo is marking the asset on its own books.

🧮 Back of the napkin math: $1.8B loan, SOFR+6.5% (or around 10.5%) means the debt service is ~$190M. That EBITDA doesn’t look too hot now, does it…

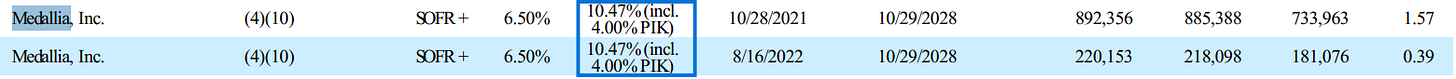

We do know the loans had a PIK component. The screenshot below is from BCRED’s 10-Q (as of 9/30/25):

👉 And here’s why keeping an eye on PIK is important:

🌲 Evergreen Funds

Evergreen funds have grown rapidly in recent years. I’ve written deep dives on a number of them:

KKR Private Equity Conglomerate (K-PEC) (private equity),

Bluerock Total Income + (real estate) and Apollo Diversified Real Estate,

Carlyle Credit Solutions (private credit), and

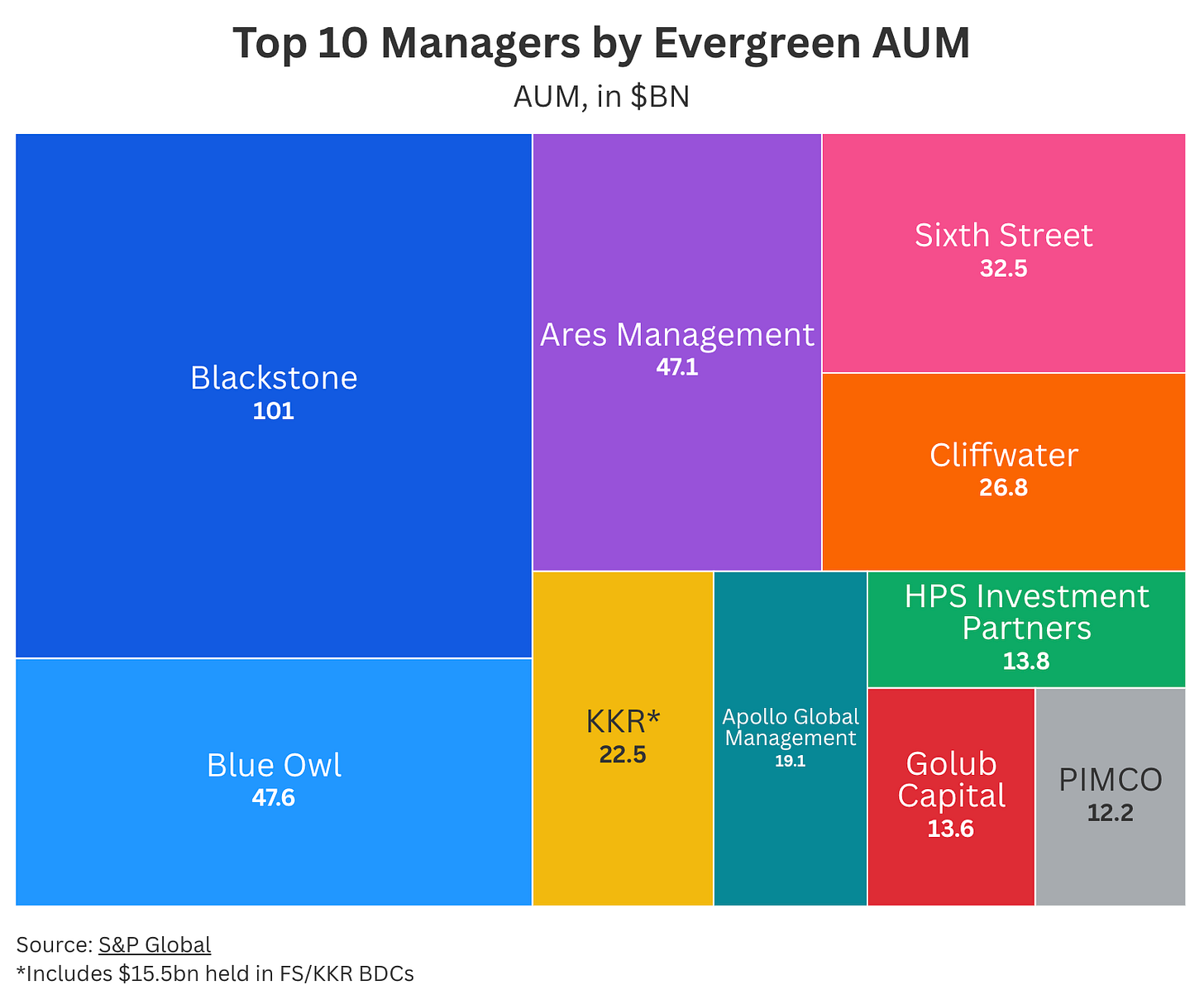

Below is the list of top 10 managers by evergreen AUM. Many of their funds target wealth and retail clients (💬 let me know in comments what fund you’d like to see a deep dive on):

If you missed the evergreen primer, it’s here:

I read a lot of reports (so you don’t have to), and one that recently stood out is this report by Evan Clark at EDHEC. If you invest in evergreen vehicles, you should read it: Clark dives into performance drivers, fees, and NAV smoothing in a clear way - and backs it up with data.

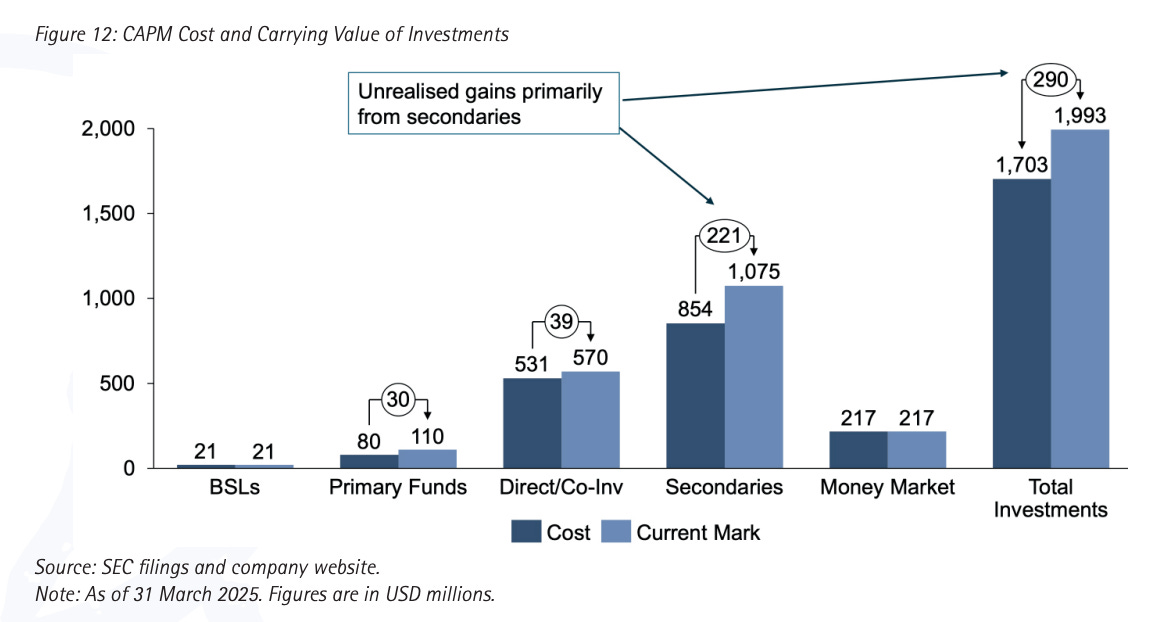

And check out the section on “one-day gains”: evergreen funds heavily exposed to secondaries are a good place to see it in action. Take Carlyle AlpInvest’s Evergreen fund. As of March 31, 2025, the fund held a little over $1.7 billion at cost and valued it just under $2 billion, creating roughly $290 million of unrealized gains.

Most of that uplift came from secondaries: they make up about half the portfolio’s cost but roughly 76% of the unrealized gains. Add primary funds, and together they generate $251 million of the total. Directs and co-investments, despite being nearly a third of the cost base, contribute only about 13–14% of the gains.

👉 Want more on evergreen secondaries? This post was a hit:

👉 And here is a great case study on secondary vehicles (Hamilton Lane’s Private Assets Fund):

New here?

Check out some of our popular topics to get started: on private credit, private equity, and commercial real estate.

Thanks for reading! As always, if you have any suggestions, reply to this email, leave a comment, or find me on socials (X and LinkedIn)

-Leyla

P.S. Hope you had a wonderful Thanksgiving! Mine included a 7-hour drive into the Canadian mountains for ski camp, only to cut it short by two days thanks to a kiddo’s injured wrist. All’s well now, though!

I think you may be missing Partners Group in the Evergreen Funds AUM chart. Their Evergreen Fund, Partners Group Private Equity (Master Fund), LLC, had a NAV of 15.8B on its latest N-CSR.

Toilets in CV😆