Unmonetized Companies, DSCR <1, and IPO to Watch

🗞️ Sunday digest: private markets insights 12/14

Happy Sunday. Every other week, we send a quick digest on what’s catching our eye across private markets.

Today’s lineup:

Private equity: The JPM report you should read (and whether secondaries are holding the market together)

💵 Private credit: Apollo’s opus magnum on private credit

🏢 Commercial real estate: A public listing to watch + DSCRs on outstanding loans (spoiler: it ain’t pretty)

📈 IPO to watch this week.

Before we dive in:

Accredited Insight delivers the LP’s perspective on private credit, private equity, and CRE, drawing on hundreds of deals, and thousands of conversations. Paid subscribers gain access to our database of over 30 case studies and articles on everything you need to become a better investor. GPs, get a front-row look at how capital allocators think.

Private Equity

Three things today: two reports, one article.

1. BlackRock Private Markets Outlook 2026

(The report reads a bit like a sales brochure—feel free to skim.)

Highlights:

Private markets AUM is forecast to grow from ~$13T today to $20T+ by 2030, led by private credit and infrastructure.

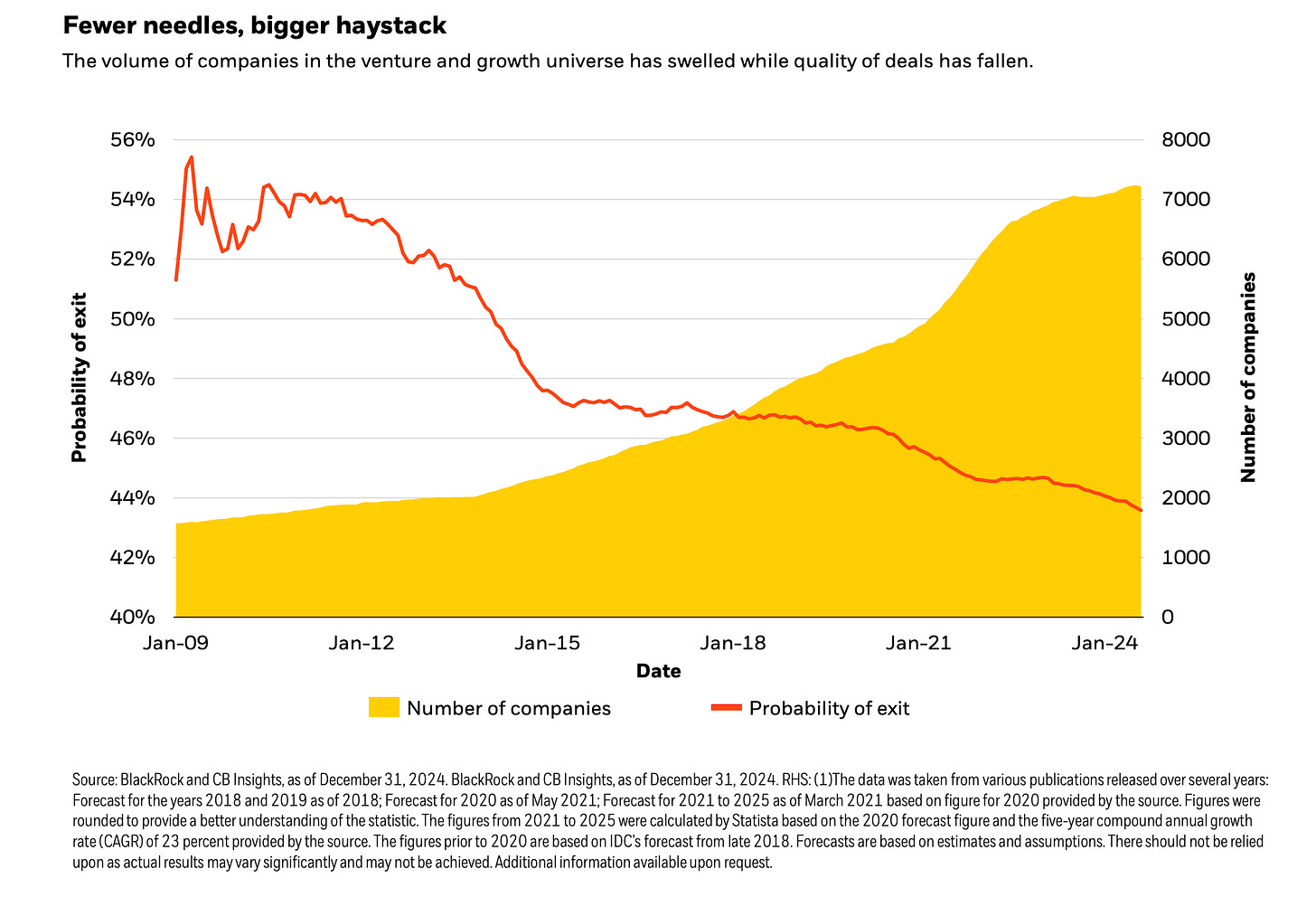

Companies are staying private longer. Many firms are delaying IPOs while maturing in private markets.

As BlackRock notes:

“Historically, a minority of companies have driven the majority of value creation. The opportunity set in growth equity has broadened considerably, but so too has the dispersion in deal quality.”

📌 Takeaway for investors: bigger opportunity, but wider gaps between good and bad deals. Picking the right fund manager is more important than ever.

2. EXCELLENT JP Morgan Report

This is the report you’ll want to bookmark and read.

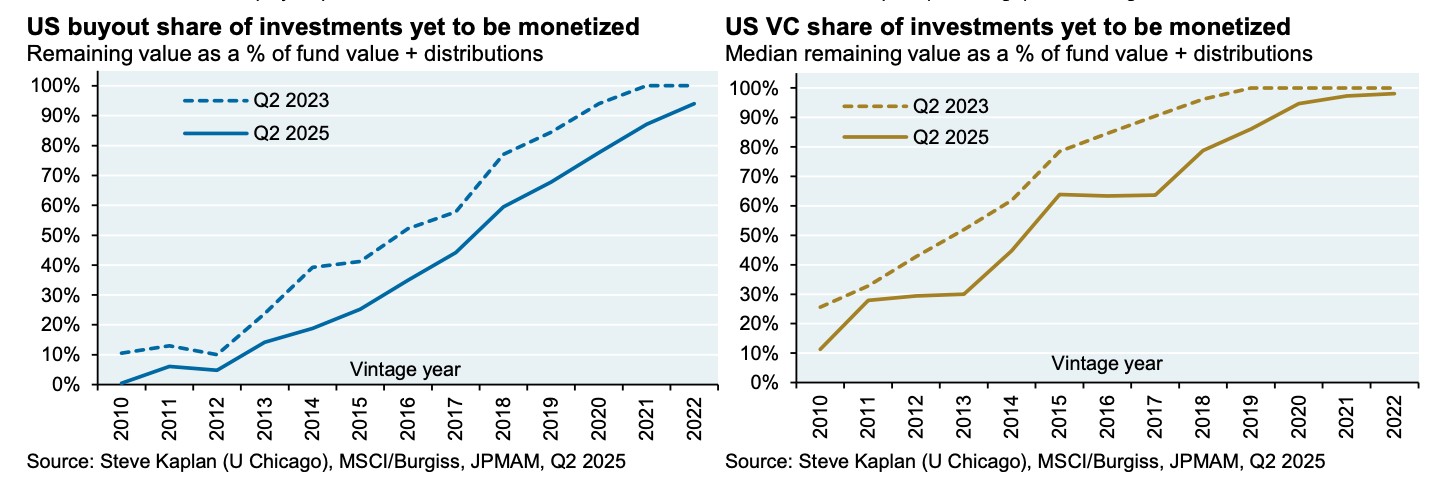

Many funds raised 2016–2019 still hold companies that haven’t been sold. In venture, most value hasn’t been realized: less than a third of a typical 2018 fund’s value has been cashed out.

Excluding the 2021 spike, private equity distributions are roughly flat despite rising AUM.

Exit activity is down, buyout holding periods are longer.

Continuation funds have become more common, helping managers generate distributions without selling to third parties.

♲ Read the CV primer here:

Secondary funds are taking up a larger share of private markets AUM, reflecting rising demand for liquidity.

🌲 And here’s how evergreen secondaries operate:

Speaking of secondaries:

A private equity CEO is sounding the alarm (Bloomberg). Jean-Marie Laurent Josi, head of Cobepa, says years of cheap money made buyout firms “less discriminating,” and now higher rates, fewer deals, and stalled exits are catching up.

“The secondary market will prevent the whole industry from crashing… The private equity industry cannot keep defying gravity.”

Performance notes:

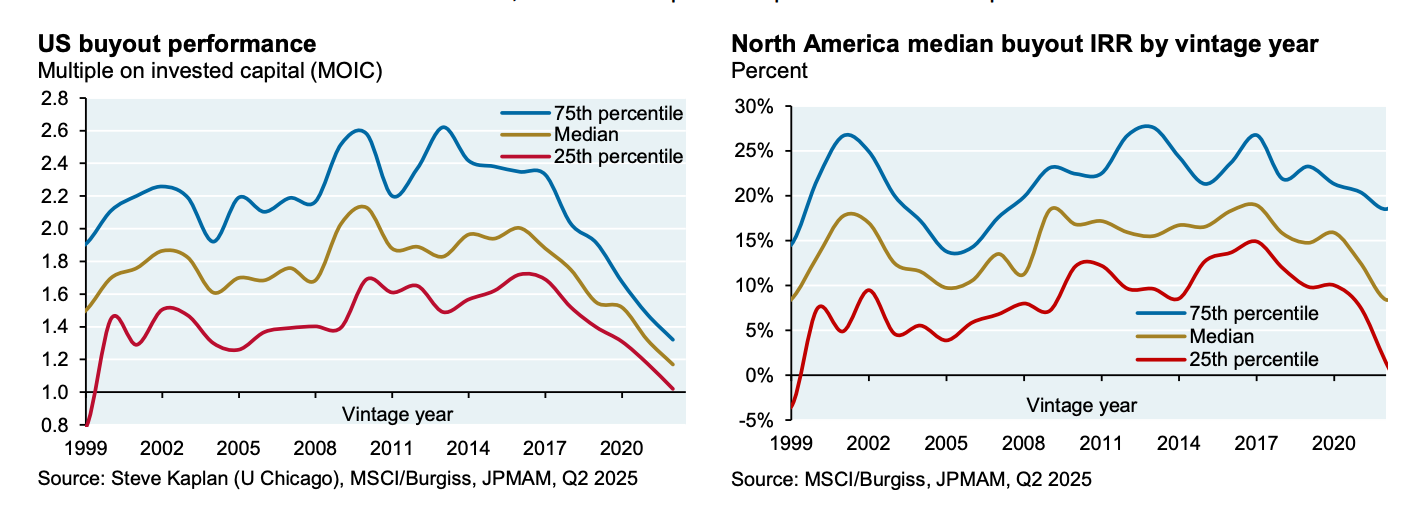

Buyouts: 1999–2019 median MOIC hovered around 2x with IRRs of 15–20%. Recent vintages are harder to gauge, as many funds are still in their commitment periods.

Venture: Performance is less consistent. 2009–2018 vintages had median MOICs of 2–2.5x and IRRs of 13–15%. Since 2019, venture performance has declined again, with much value still unrealized.

💵 Private Credit

Apollo just released a 125-page report on private credit. Part sales pitch, part defense against negative press, it’s worth a read, if you keep in mind Apollo’s bias (and the occasional spelling error, which tells me it was rushed). A lot of info on Athene (Apollo’s insurance arm).

Here’s the main argument, straight from the deck:

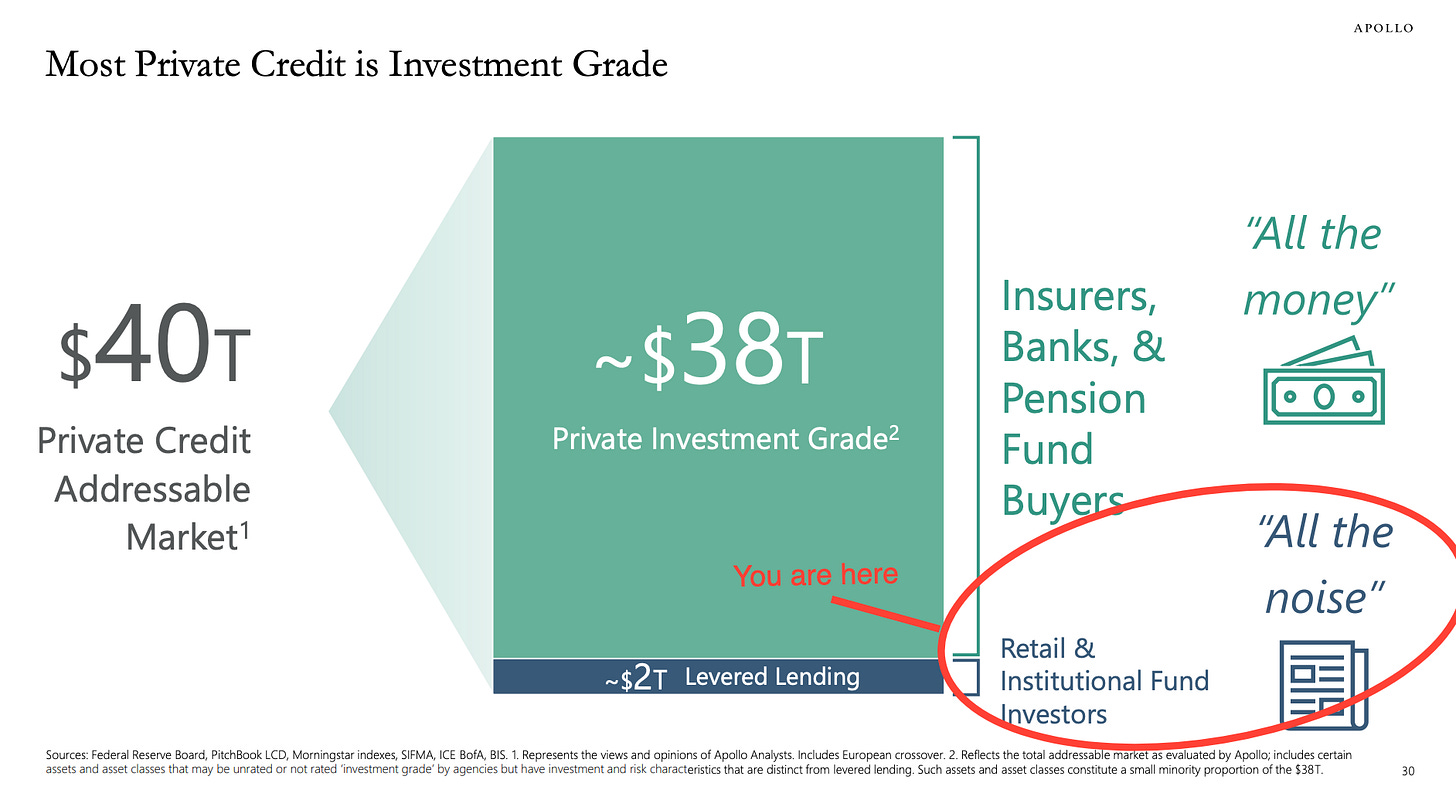

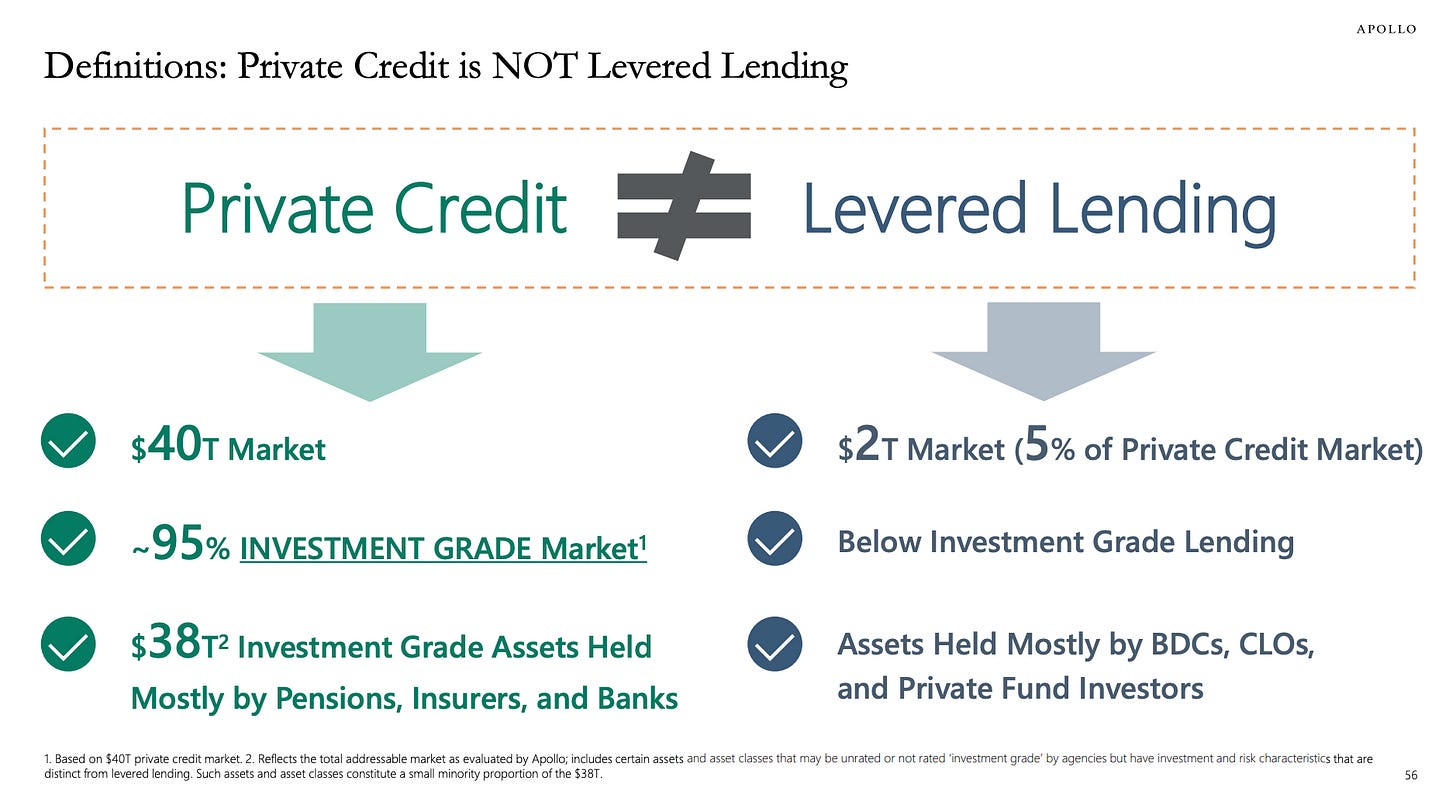

“Conclusion: Private Credit is Predominantly Investment Grade (95% / $38 Trillion). Levered Lending is a Small Slice (5% / $2 Trillion). Levered Lending is Just an Investment, With Limited Held on the Balance Sheets of Banks or Other Financial Institutions.”

No idea what they mean by levered lending being “just an investment” - but if you are a retail investor, your exposure is entirely in the “noise” category. Proceed accordingly.

👉 Invest in private credit? Read this:

Commercial Real Estate

I want to highlight two things here:

1. Apartment Supply

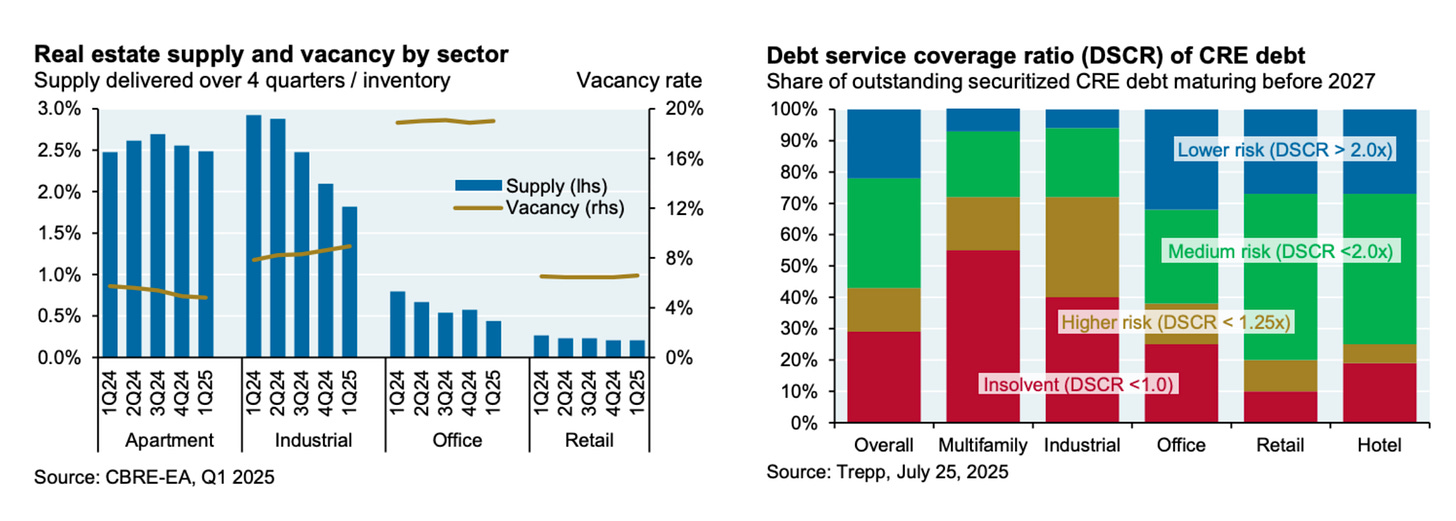

There’s still a lot of new apartment inventory coming to market, but the peak is behind us. Current Yardi Matrix data shows new supply peaked in 2024 at 685,005 units, a 53.7% increase from 2021’s level.

Vacancy is starting to drop, meaning the supply is being absorbed, this is very good to see.

2. Debt Service Coverage (DSCR) on Securitized CRE Loans - this is a big deal

About 55% of multifamily loans in securitized pools have a DSCR < 1.0. This is bad. This means the underlying property is not generating enough cash flow to service its debt. Even office, the asset class that got decimated over the past few years, is looking to be in better shape.

What are CLOs? Glad you asked:

How is all this getting resolved?

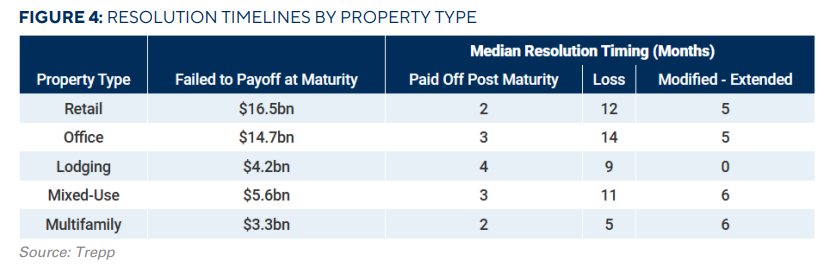

Trepp sampled $133B worth of CRE loans maturing between 2020-2025.

Failed to pay off at maturity:

- 40% of office

- 35% of retail

- 30% of MF

- only 5% for industrial and self-storage.

And here’s the resolution timing:

IPO to Watch: Bluerock Total Income+ Fund

Even if you’re not invested, this is a must-watch for anyone with exposure to evergreen vehicles. This real estate secondaries fund has a sizable redemption queue (22% of fund’s NAV as of June).

On Tuesday, December 16, the fund will list on the NYSE under the ticker BPRE, rebranded as the Bluerock Private Real Estate Fund. The market will tell us how investors value the private assets inside; the annual report notes the fund “will likely trade at an initial discount to its NAV upon listing.”

New here?

Check out some of our popular topics to get started: on private credit, private equity, and commercial real estate.

Thanks for reading! As always, if you have any suggestions, reply to this email, leave a comment, or find me on socials (X and LinkedIn)

-Leyla

That data on DSCR is incredible. I wonder when the notes are due? If they are 5 plus years out at 5% NOI growth a year they might be ok, otherwise it looks like prices might drop.