PE Returns, SaaS Bloodbath in Private Credit, and MF Green Shoots 🌱

🗞️ Sunday digest: private markets insights 2/7

Happy Sunday! Every other week, we send a quick digest on what’s catching our eye across private markets.

Today’s lineup:

1️⃣ Private equity: one endowment lowers return projections, lowest annual distribution rate on record, but hey, private assets are amazing (according to Apollo)!

2️⃣ Private credit: the SaaS bloodbath, and its effect on private credit funds

3️⃣ Commercial real estate: multifamily outlook (plus market-specific reports)

Before we dive in:

Accredited Insight delivers the LP’s perspective on private credit, private equity, and CRE, drawing on hundreds of deals, and thousands of conversations. Paid subscribers gain access to our database of over 30 case studies and articles on everything from evergreen funds to due diligence.

1️⃣ Private Equity

TL;DR:

Princeton lowers its return expectations after years of heavy PE exposure.

Distributions are hitting historic lows relative to NAV.

Meanwhile, Apollo argues: private assets are awesome (are we surprised??)

Princeton University just slashed its long-term endowment return assumption from 10.2% to 8%, citing heavy exposure to crowded private equity markets and changing fundamentals (FT LINK). President Christopher Eisgruber added that even 8% “might be considered aggressive.” 🫠

After a record 47% return in 2021, Princeton has now posted two consecutive years of negative performance. Its 20-year rolling return has fallen from 14% in 2005 to under 10% in 2025.

Former CIO Britt Harris called it a reality check: “There is probably no way to hold a diversified portfolio and reach a double-digit return target over a long period of time… Princeton has just come down to what is normal.”

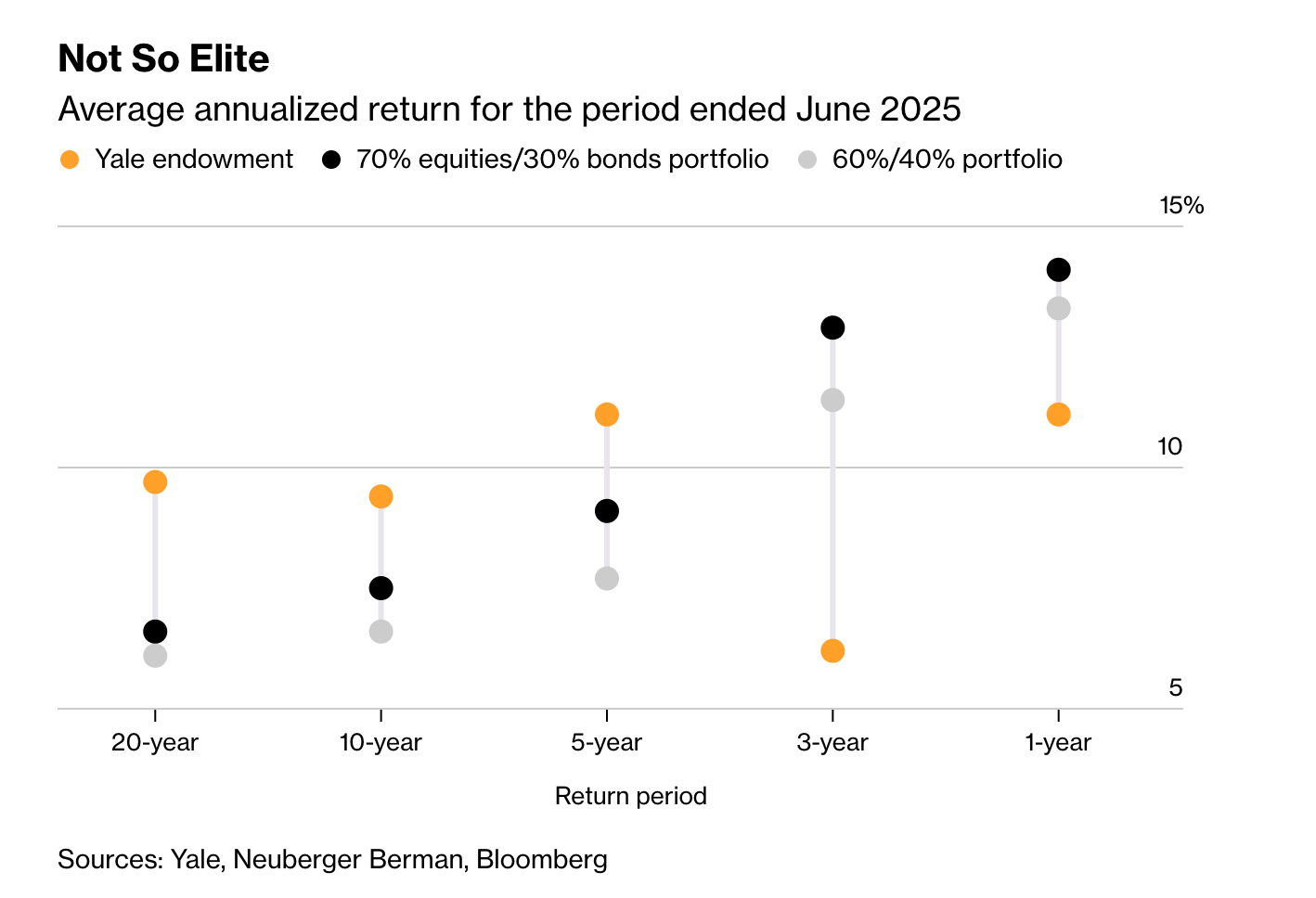

I’ve said this before and I’ll say it again: the Yale model worked in the ’80s and ’90s for one simple reason — there wasn’t a tidal wave of capital chasing deals. Buyouts were done at reasonable entry prices.

Today, small and mid-size businesses are being acquired at sky-high valuations, often with little margin for error. High entry prices make outsized returns harder to achieve (even with leverage, even with financial engineering).

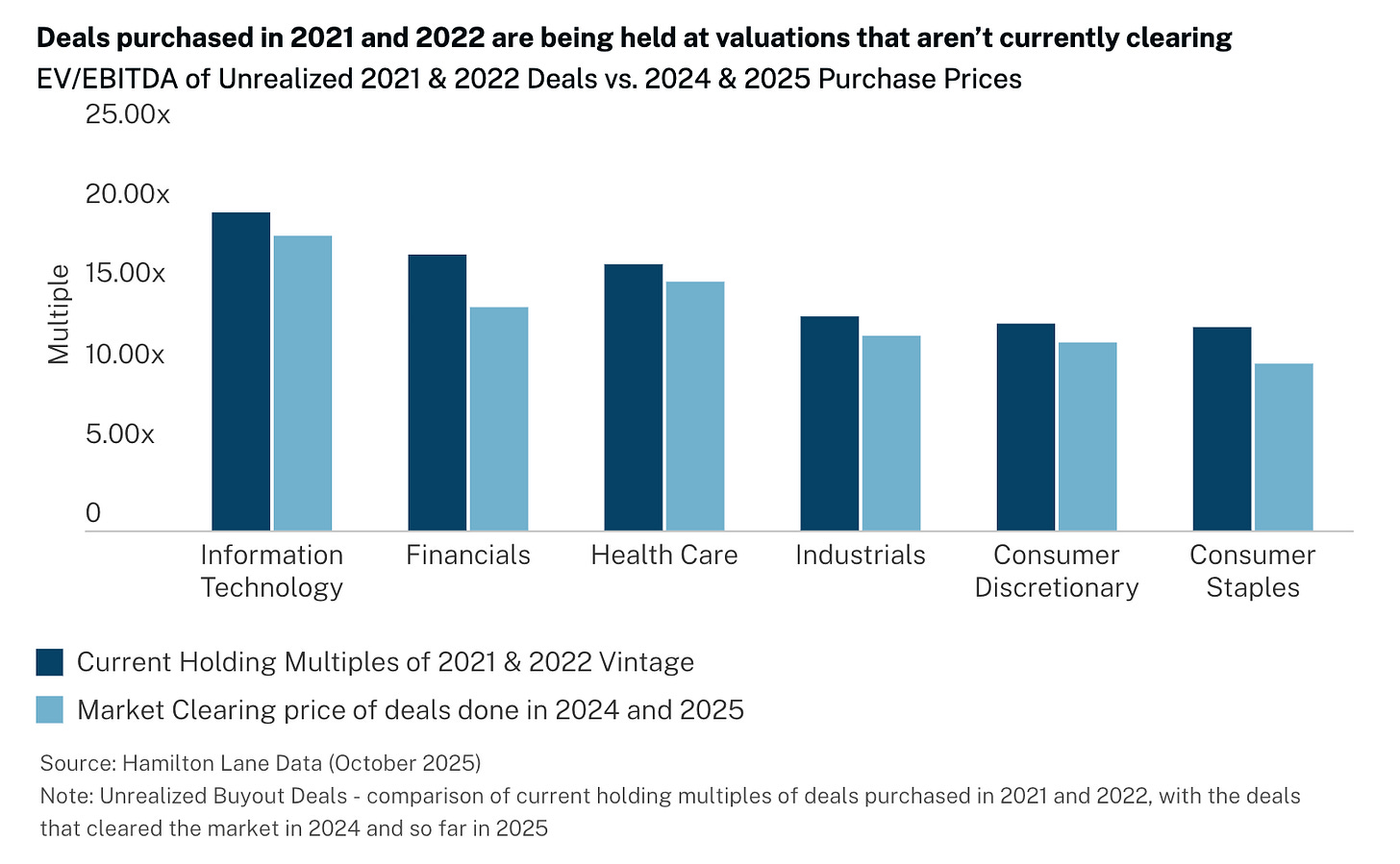

Just look at this:

👉 Thinking about PE exposure? Start here

2. Hamilton Lane’s stupendous mid-year report

(they use memes! and interactive charts! - LINK). Two things caught my eye:

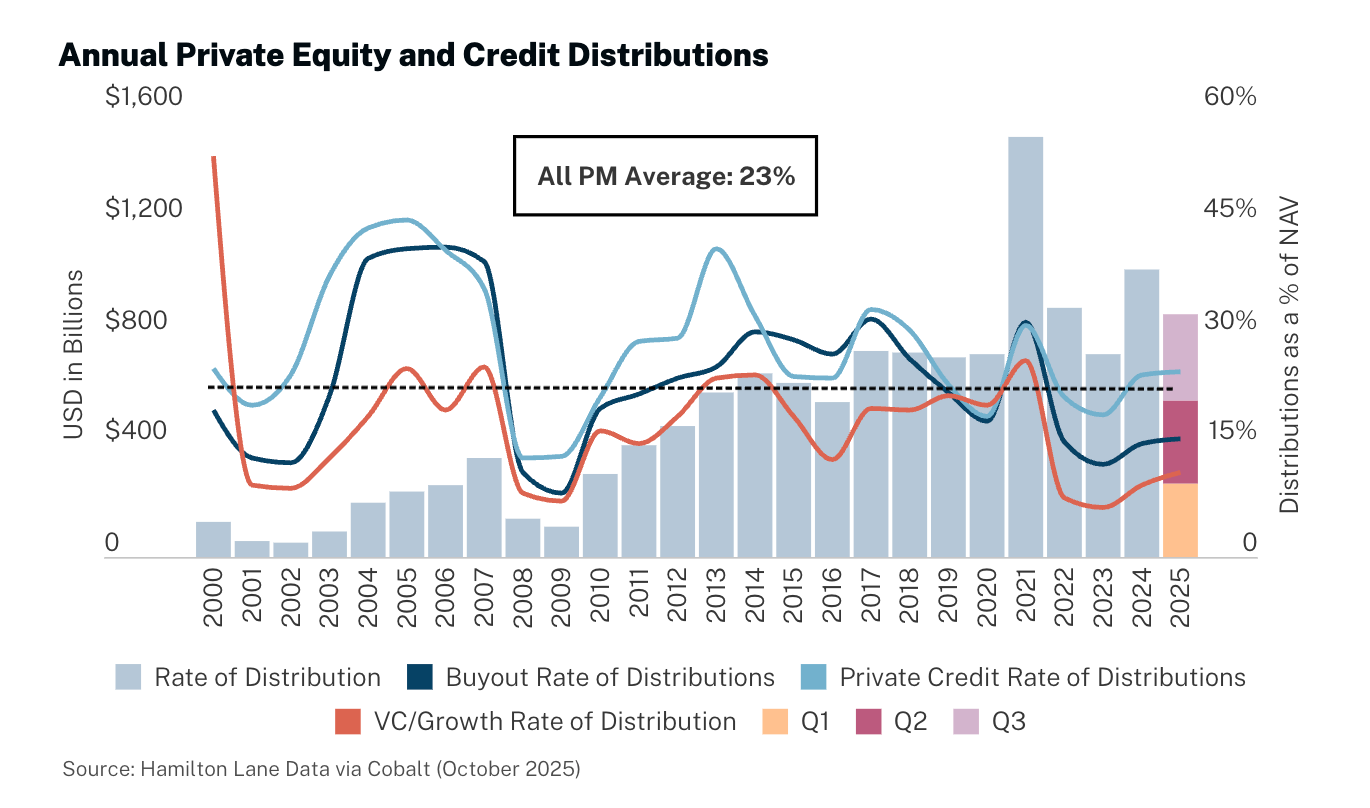

Distributions: in absolute dollars, distributions are near record highs. But as a percentage of NAV, they’re near record lows. LPs are getting money back, just not nearly enough relative to how much capital they’ve committed in recent years.

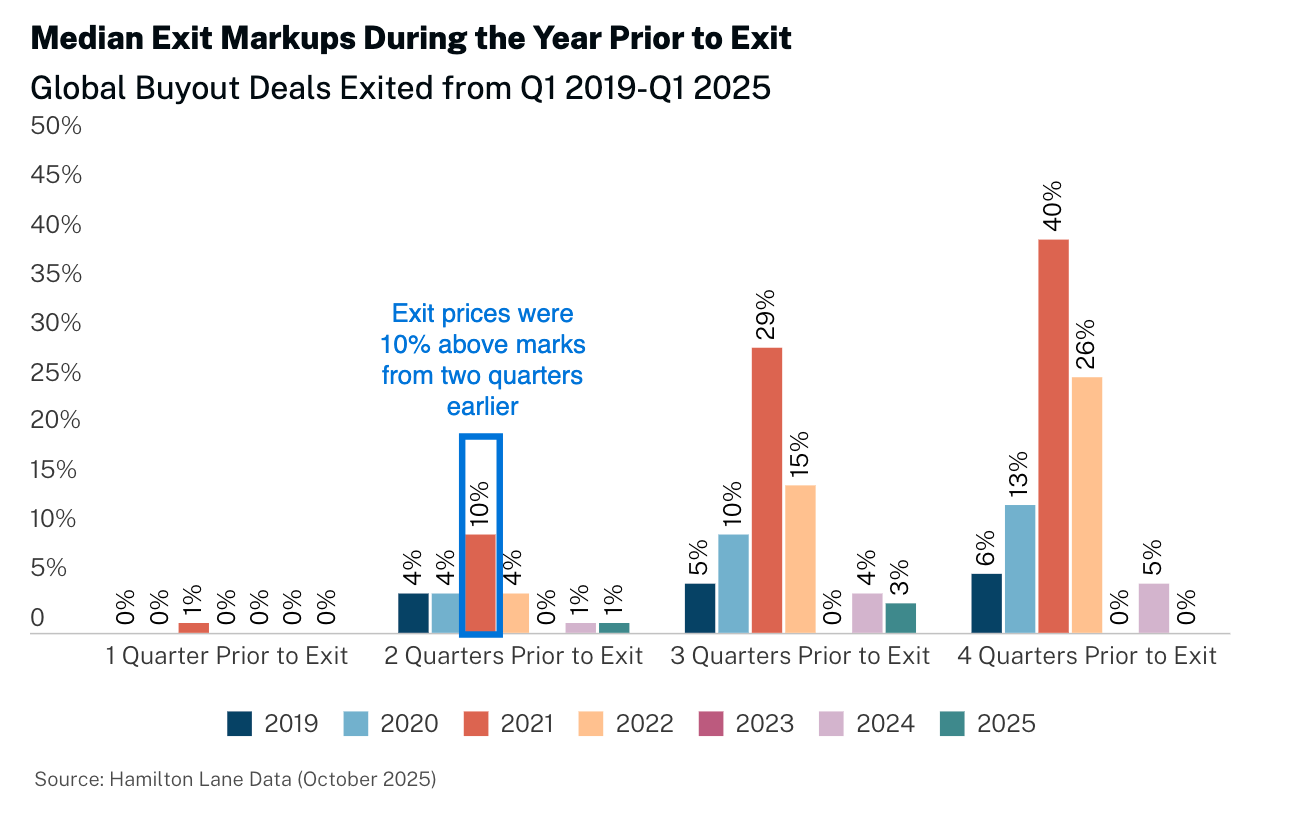

Exit pricing: in 2021, exit prices were about 10% higher than marks two quarters prior to exit. That premium is gone. Today, exits are happening at or near recent marks, not above them.

⚠️ And this one should give pause if you’re allocated to 2021–2022 vintage funds. Current holding multiples are higher than market-clearing prices for comparable assets.

3. This chart needs to be discussed, folks

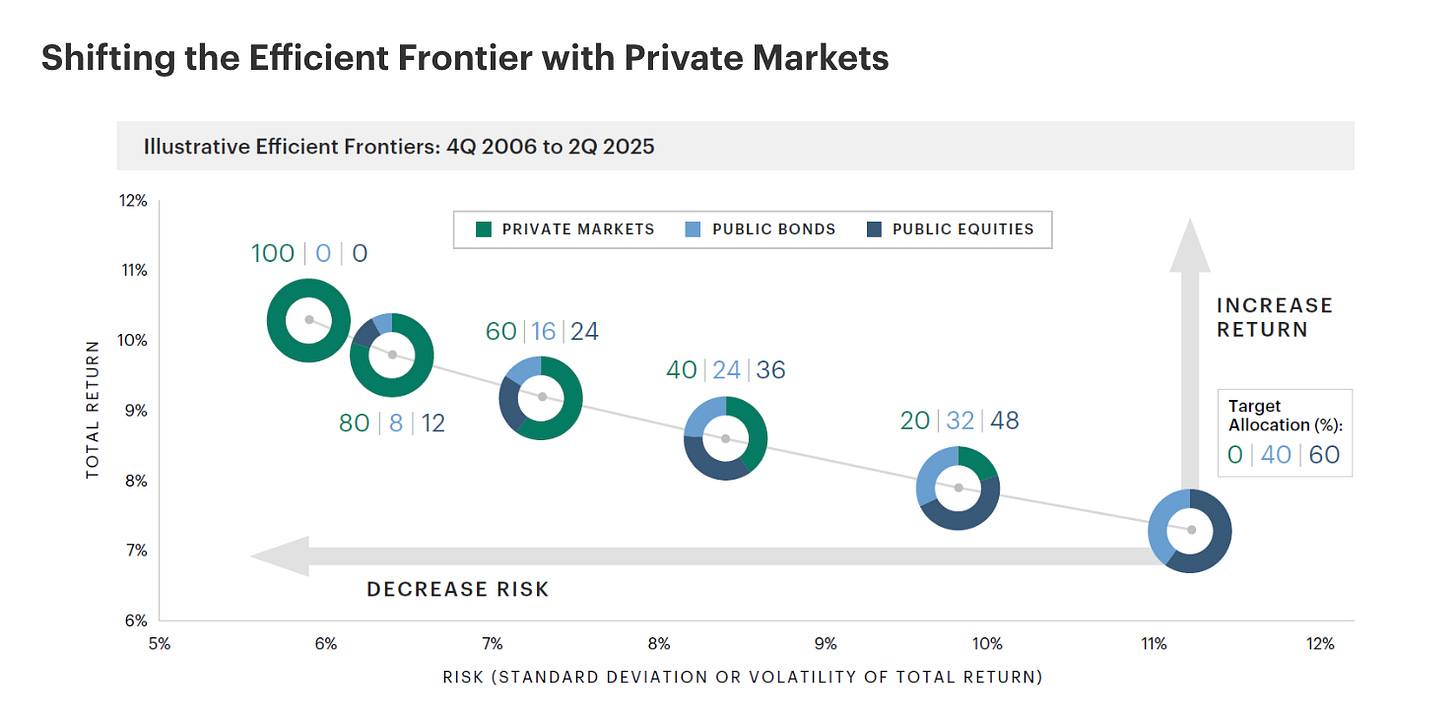

This is from the Apollo Academy. Two things of note:

First, equating risk with volatility is disingenuous when we all know volatility in private markets is largely laundered through infrequent marks.

Second, what exactly is included in “total return”?

If that number includes unrealized gains based on manager marks, then I’ll just chuckle in my corner.

2️⃣ Private Credit

TL;DR:

The SaaSpocalypse is bleeding into BDCs, and UBS warns private credit defaults could hit 13%.

Asset-Based Finance isn’t bulletproof after all.

Another private credit secondaries strategy enters the chat.

👉 New here? Want to learn more about PC secondaries? Read this:

UBS is warning that private credit may be more exposed to AI-driven disruption than investors realize (Bloomberg LINK). In an aggressive AI-disruption scenario, U.S. private credit default rates could rise as high as 13%.

The concern? AI accelerates business-model obsolescence, particularly in technology and services (these sectors make up an estimated 35% of the $1.7 trillion private credit market).

Private lenders are deeply intertwined with the AI build-out itself, financing everything from infrastructure to software through direct lending, asset-based finance, and structured credit. More than $200 billion of private credit is already tied to AI-related companies, and that figure is expected to multiply.

👉 Invest in private credit? Start here:

2. Even ABF takes a hit

Apollo took a previously unreported loss on part of a roughly $170 million asset-backed financing tied to Amazon brand aggregator Perch (LINK). It’s a rare setback for asset-based finance (ABF), a strategy Apollo has long positioned as safer than traditional private credit.

👉 What’s ABF? Read this:

The exposure was indirect, structured through credit facilities run by Victory Park Capital, with seniority and loss-absorbing protections in place. Still, Perch’s collapse resulted in losses booked about a year ago.

Apollo emphasized the loss was immaterial and that recoveries were meaningfully higher than those experienced by direct lenders.

3. Another private credit secondaries strategy

Add another entrant to the growing private credit secondaries universe.

Dawson Partners, a $25 billion AUM firm, announced plans to launch a strategy focused on the fast-growing credit secondaries market (LINK). The firm decided to formalize the strategy after participating in multiple secondaries transactions, including Crescent Capital’s continuation fund and the purchase of assets from the Hong Kong Jockey Club.

👉 I’ve said this before and I’ll say it again: there will be more private credit secondaries funds. Here’s a deep dive into one:

3️⃣ Commercial Real Estate

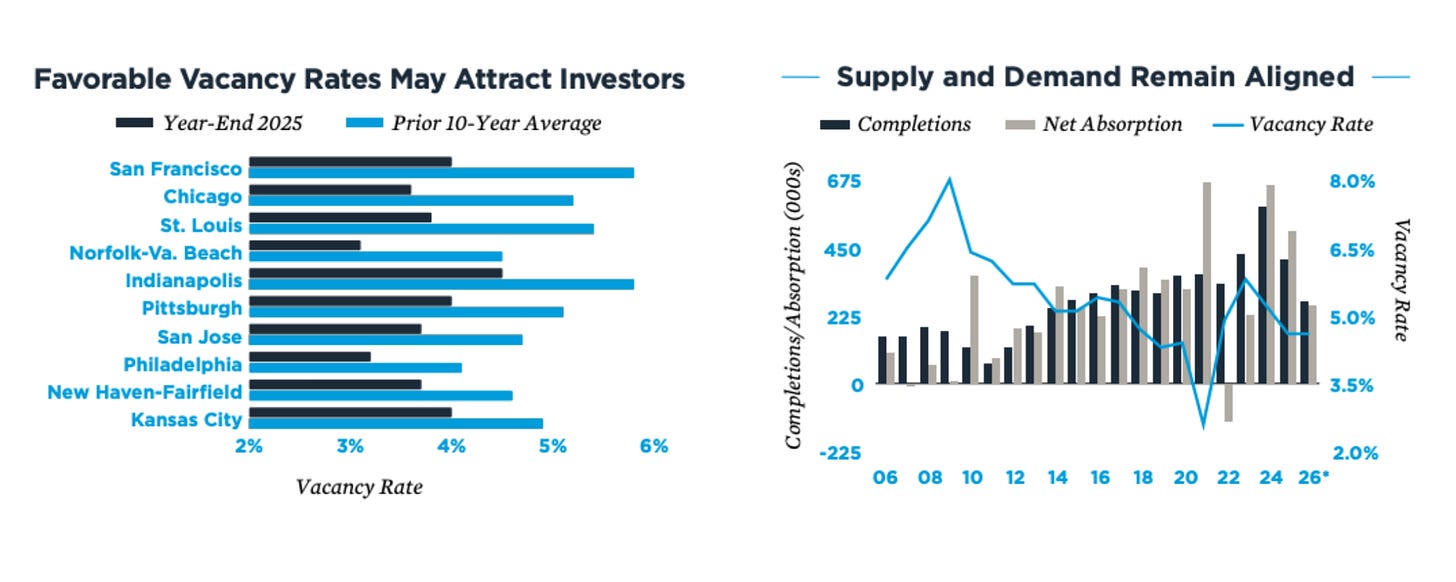

IPA published a 2026 multifamily investment forecast. You can find market-specific reports here.

🏢 National Overview

Rental demand is broadly balanced heading into 2026. Softer labor conditions pose greater risk to Class B and C assets, while Class A benefits from a sharp slowdown in new supply (hallelujah!).

🏦 Capital Markets

Capital availability is improving as banks re-enter the market and agency lending expands. 2026 cap rates are up more than 20%, creating more workable entry points.

Private equity activity is picking up, and recent rate cuts are easing financing conditions. Multifamily lending is projected to increase by more than 10% this year.

📈 Investment Outlook

Rate cuts, broader lender participation, and higher leverage are helping more deals pencil after a rebound in investment activity in 2025.

Long-term demand drivers remain intact. High in-migration Sun Belt metros continue to benefit from demographic tailwinds, while Northeast and Midwest markets are seeing tighter vacancies due to limited new supply.

🏢 Invest in real estate as a limited partner? Here’s our series on how to read a real estate pro forma.

New here?

Check out some of our popular topics to get started: on private credit, private equity, and commercial real estate.

Thanks for reading! As always, if you have any suggestions, reply to this email, leave a comment, or find me on socials (unhinged me on X and a more tame me on LinkedIn)

-Leyla

Are these PC secondary funds private in nature or will some be listed/public? Do we really need any more private credit funds at this point? Will this help out with LP liquidity or just kick the can?

Dawson funds are in the Billions rather than Millions. Apparently they have raised over $25Billion since their start 10 years ago. I have an invite into their latest offer on my desk but don’t plan to proceed myself.