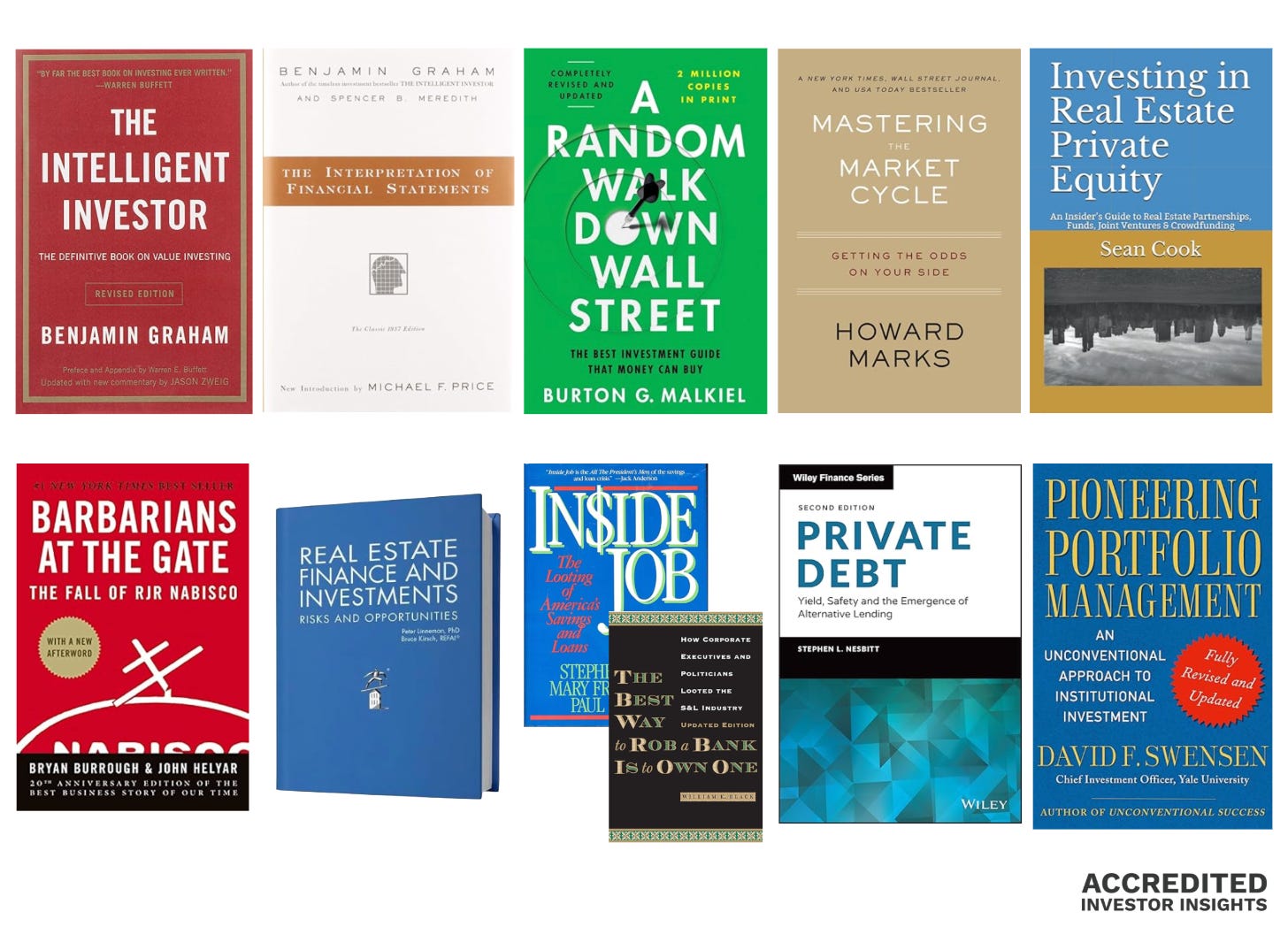

Top 10 Books 📚 + Top 10 Posts

Required reading, and most-read posts

I hope you’re having a wonderful holiday season with friends and family (and avoiding open combat with that one relative who made a lot of money on fartcoin).

As another year comes to a close, I want to say thank you. Accredited Investor Insights has grown from under 2,000 subscribers to more than 11,000 in 2025, and is now read in all 50 states and 132 countries.

📈 That 485% annual growth rate is entirely because of your support, your feedback, and the many thoughtful conversations this community has made possible.

Today, I wanted to share two things:

📚 my top 10 book recommendations,

a look back at the top 10 posts from the year.

💬 One quick ask: please drop your book recommendations in the comments. Anything that has helped you become a better-educated investor in private markets.

Before we dive in:

Accredited Insight delivers the LP’s perspective on private credit, private equity, and CRE, drawing on hundreds of deals, and thousands of conversations. We are committed to remaining an independent voice in private markets, with a focus on education, risk awareness, and clear-eyed analysis.

Top 10 Books

This is my current top 10 list

(yes, it’s eclectic; yes, I read most of them years ago; yes, I’ll update it next year).

I write about private markets. Yet several of these books focus on public markets, and one (really, two) center on the Savings & Loan crisis. That’s by design, let me explain.

Some of these books are practical how-to’s. Others are meant to sharpen how you think about risk, returns, and opportunity cost.

1. The Intelligent Investor (👈this is a link) — Benjamin Graham.

You’ve all heard of it. Most of you have read it.

So why is this my number one recommendation for private market investors? Two reasons:

Because you need to understand what you are giving up when you allocate capital to private markets. In public markets, you occasionally get the opportunity to buy a dollar for $0.60. In private markets, that kind of mispricing is far rarer (hello, NAV marks).

The book teaches you what matters: valuation, margin of safety, and patience (regardless of liquidity).

2. The Interpretation of Financial Statements — Benjamin Graham.

Written in 1937, this is a refreshingly simple read from pre-GAAP times.

Don’t overlook it because of its age. It’s concise, accessible, and one of the clearest primers on financial statements ever written. You don’t need to be a CPA to benefit (and mercifully, Graham goes easy on double-entry accounting).

More on how to read financial statements:

3. A Random Walk Down Wall Street — Burton G. Malkiel.

Some lore: this was the second investing book I ever read (the first was The Intelligent Investor). I was about 19 at the time.

Malkiel makes a strong case for avoiding brain damage by dollar-cost averaging into index funds. To my 19-year-old self, that was a far more attractive proposition than trying to find “cigarette butts.” I started doing it then, and it worked out. Decades later, when my oldest got his first summer job, I strong-armed encouraged him to do the same. (None of this is investment advice, btw).

You can argue that indexing is dead, that private markets will outperform, or that “this time is different.” I’m open to the debate (the comment section is all yours).

The point remains: this book is essential for understanding just how hard it is to beat the market, especially after fees.

P.S. Yes, private markets are changing the game. That’s why I do what I do.

4. Mastering the Market Cycle — Howard Marks.

Great read on investor behavior throughout the cycle. Subscribe to read his memos, while you are at it (or listen to his podcast).

5. Investing in Real Estate Private Equity — Sean Cook.

Many of you invest in private placement real estate, and this is an excellent place to start.

It’s relatively short, not overly technical, and very clearly written. A solid foundation for understanding how real estate private equity actually works in practice.

Here’s Part 1 in our series on the subject:

6. Barbarians at the Gate — Bryan Burrough and John Helyar.

The story of KKR’s battle for RJR Nabisco in 1988.

It’s a fantastic window into the world of leveraged buyouts (the big egos, competition, incentives, and excess). And remember: this happened nearly 40 years ago.

The industry is only more competitive today, with more capital, more players, and bigger stakes (and likely bigger egos).

Speaking of KKR, here’s a deep dive into one of their funds:

7. Real Estate Finance and Investments — Peter Linneman and Bruce Kirsh.

This one is technical. Probably an overkill for most LPs, but putting it out there because it’s a good resource.

It goes deep into commercial real estate finance and underwriting. If you want to understand the mechanics beneath the surface, this is the book.

8. The Best Way to Rob a Bank Is to Own One — William Black.

An insider’s account of the Savings & Loan crisis of the 1980s and a timeless lesson in what Black calls “control fraud.”

The main idea: the most damaging financial frauds are often committed not by outsiders, but by executives who control firms and use them as vehicles for personal enrichment. Incentives drive behavior, and opacity is fertile breeding ground for fraud.

If you go down the S&L rabbit hole, The Inside Job by Stephen Pizzo, Mary Fricker and Paul Muolo is another good read - more investigative in style, written by journalists rather than a regulator.

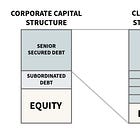

9. Private Debt by Stephen Nesbitt.

A primer on private credit.

Keep in mind that the author is the CEO of Cliffwater, so read it with that context, but it’s still a useful overview of the asset class many LPs are now heavily exposed to.

10. Pioneering Portfolio Management by David F. Swensen.

The book that gave birth to the spread of Yale Endowment Model.

Essential reading for understanding how institutional investors think about diversification, illiquidity, and long-term capital allocation.

Just keep in mind this was written in the 1980s. The illiquidity premium is mostly gone, by the way:

Top 10 Posts

If you’re new here, these were the most-read posts of the year.

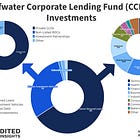

1. Deep dive on CCLFX (an evergreen private credit fund):

2. A primer on secondary funds.

3. Bluerock Total Income Plus → Bluerock Private Real Estate Fund (NYSE: BPRE): what happens when an evergreen illiquid fund runs into liquidity issues (and lists on a public exchange):

4. Primer on evergreen funds:

5. KKR Private Equity Conglomerate (K-PEC) deep dive.

6. On CLOs:

7. How to Read a Real Estate Proforma: the metric to rule them all, Yield on Cost (the entire 5-part series on how to read pro formas can be found here)

8. Blackstone Private Equity Strategies Fund deep dive:

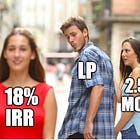

9. Why IRR is a useless metric:

10. Private Equity 101 (first in a series, here’s Part 2 and Part 3)

New here?

Here’s more on private credit, private equity, and commercial real estate. Using AI in due diligence is something I’m asked about all the time.

If something made you nod (or disagree) hit reply or leave a comment. I’d love to hear from you.

-Leyla

P.S. You can also find me on X and LinkedIn

P.P.S. If this 485% growth rate continues, the newsletter will be giving some major asset managers a run for their money in about five years 😂

Post idea/Question - For the private funds that you review/deep dive how do you go about accessing the quarterly letters/returns/financials etc. Are they always available on firms websites or do you have to go through SEC filing websites, use a proprietary database? or find a shareholder? Since these are private funds I assume they are more difficult to access than regular public company/fund filings. Maybe it would be worth it to do a post on how you acquire the fund filings that you review if it isn't a straightforward process.

Book suggestion - The Money Game by Adam Smith. The more things change, the more they stay the same.